Question:

You recently received the following e-mail from a client and friend: Hey Great Student, I cannot believe it is almost year end! Only a few days before it’s 2019. As you recall, I was lucky enough to win big at the casino back on New Year’s Day earlier this year (thanks for celebrating with me). I took the $3,000 I won and bought 100 shares of stock in that cool new smartphone app company, Trivia Addiction. I just love playing that game. Anyway, the stock has done well, and I am thinking of selling before year end now that the price has reached $240 per share. Since you are my tax adviser, I thought I’d ask a couple of questions:

1. Is there any reason to wait and sell later?

2. If I don’t sell, the price might go down (TriviaMaster seems to be replacing TriviaAddiction as the “hot” new game).

I’m thinking the price might be as low as $220 by early next year. My taxable income this year and next year is expected to be $38,500 (not including the stock sale). I think that puts me in the 12% tax bracket? Any suggestions on what I should do? Thanks! Sue Prepare an e-mail to your friend Sue addressing her questions. Be certain to include estimates of the different after-tax outcomes she is suggesting. Sue is a single taxpayer and not a tax expert and so your language should reflect her limited understanding of tax law and avoid technical jargon. Although Sue is your friend, she is also a client and your e-mail should maintain a professional style.

Transcribed Image Text:

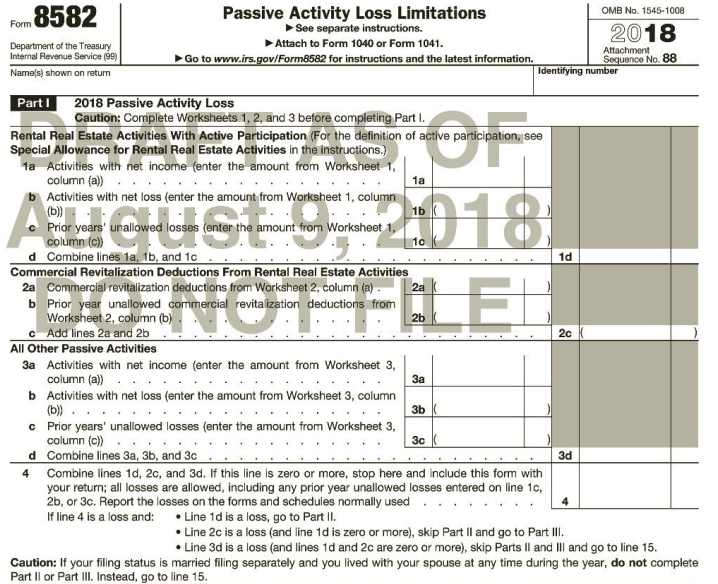

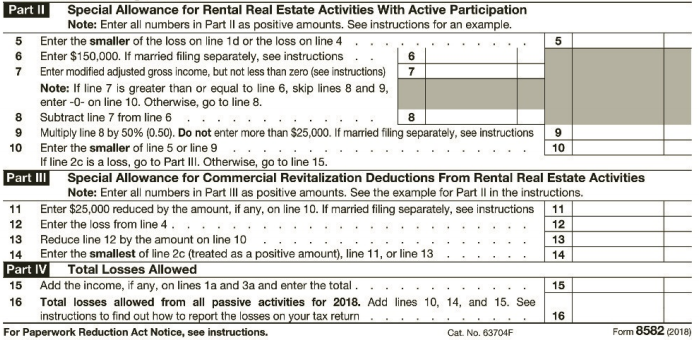

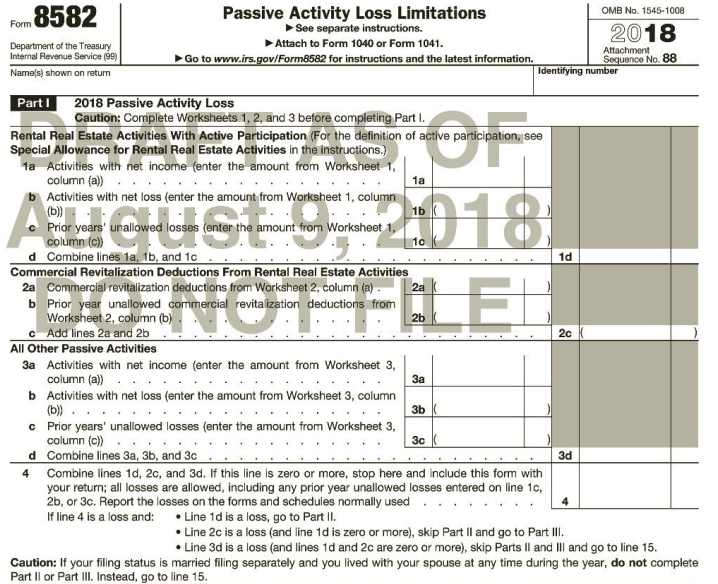

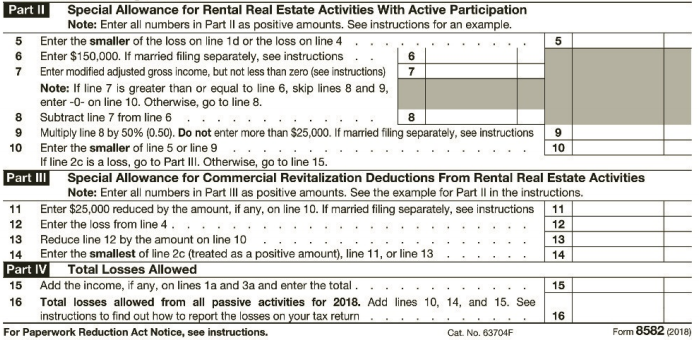

Passive Activity Loss Limitations See separate instructions. OMB No. 1545-1008 Fom 8582 2018 Attach to Form 1040 or Form 1041. Department of the Treasury Internal Revenue Service (99) Attachment Go to www.irs.gov/Form8582 for instructions and the latest information. Sequence No. 88 Identifying number Name(s) shown on return 2018 Passive Activity Loss Caution: Complete Worksheets 1, 2, and 3 before completing Part I. Rental Real Estate Activities With Active Participation (For the definition of active Special Allowance for Rental Real Estate Activities in the instructions.) 1a Activities with net income (enter the amount from Worksheet 1, column (a)) b Activities with net loss (enter the amount from Worksheet 1, column (b) Prior years' unallowed column d Combine lines 1a, 16, and 1c Commercial Revitalization Deductions From Rental Real Estate Activities 2a Commercial revitalization deductions from Worksheet 2, column (a) . b Prior year unallowed commercial revitalization deductions from Worksheet 2, column (b) Part I AS OF ALIGUST 9,2018 1ONOT TILE bation, see 1a the amount from Worksheet 1, 1d 2a 2b Add lines 2a and 2b 20 All Other Passive Activities 3a Activities with net income (enter the amount from Worksheet 3, column (a)) b Activities with net loss (enter the amount from Worksheet 3, column За зь (b) c Prior years' unallowed losses (enter the amount from Worksheet 3, column (c)) Зс d Combine lines 3a, 3b, and 3c 3d Combine lines 1d, 2c, and 3d. If this line is zero or more, stop here and include this form with your return; all losses are allowed, including any prior year unallowed losses entered on line 1c, 2b, or 3c. Report the losses on the forms and schedules normally used If line 4 is a loss and: • Line 1d is a loss, go to Part II. 4 Line 2c is a loss (and line 1d is zero or more), skip Part Il and go to Part II. • Line 3d is a loss (and lines 1d and 2c are zero or more), skip Parts Il and III and go to line 15. Caution: If your filing status is married filing separately and you lived with your spouse at any time during the year, do not complete Part Il or Part III. Instead, go to line 15. Part II Special Allowance for Rental Real Estate Activities With Active Participation Note: Enter all numbers in Part Il as positive amounts. See instructions for an example. Enter the smaller of the loss on line 1d or the loss on line 4 Enter $150,000. If married filing separately, see instructions Enter modified adjusted gross income, but not less than zero (see instructions) Note: If line 7 is greater than or equal to line 6, skip lines 8 and 9, enter -0- on line 10. Otherwise, go to line 8. Subtract line 7 from line 6 9 Multiply line 8 by 50% (0.50). Do not enter more than $25,000. If married filing separately, see instructions 9. 10 Enter the smaller of line 5 or line 9 10 If line 2c is a loss, go to Part III. Otherwise, go to line 15. Part III Special Allowance for Commercial Revitalization Deductions From Rental Real Estate Activities Note: Enter all numbers in Part II as positive amounts. See the example for Part Il in the instructions. Enter $25,000 reduced by the amount, if any, on line 10. If married filing separately, see instructions Enter the loss from line 4. Reduce line 12 by the amount on line 10 Enter the smallest of line 2c (treated as a positive amount), line 11, or line 13 Part IV Total Losses Allowed Add the income, if any, on lines 1a and 3a and enter the total. 11 11 12 12 13 13 14 14 15 15 16 Total losses allowed from all passive activities for 2018. Add lines 10, 14, and 15. See instructions to find out how to report the losses on your tax return 16 For Paperwork Reduction Act Notice, see instructions. Cat. No. 63704F Form 8582 (2018)