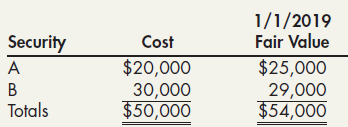

At the beginning of 2019, Ace Company had the following portfolio of investments in available-for-sale debt securities

Question:

At the beginning of 2019, Ace Company had the following portfolio of investments in available-for-sale debt securities (all of which were acquired at par value):

During 2019, the following transactions occurred:

May 3 Purchased C debt securities at their par value for $50,000.

July 1 Sold all of the A securities for $25,000 plus interest of $1,000.

Dec. 31 Received interest of $7,600 on the B and C securities. Additionally the following information was available:

...............................12/31/2019

Security..................Fair Value

B ...............................$29,000

C .................................52,500

Required:

1. Prepare journal entries to record the preceding information.

2. What is the balance in the Unrealized Holding Gain/Loss account on December 31, 2019?

3. Next Level What justification does the FASB give for its treatment of unrealized holding gains and losses for available-for-sale securities?

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach