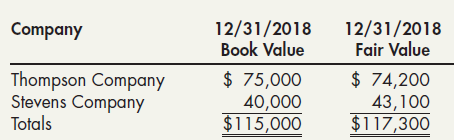

At the end of 2018, Hodge Company prepared the following schedule of investments in trading debt securities

Question:

At the end of 2018, Hodge Company prepared the following schedule of investments in trading debt securities (all of which were acquired at par value):

During 2019, the following transactions occurred:

July 1 Purchased Little Company debt securities for $100,000 (which is equal to par value). The securities carry an annual interest rate of 10%, mature on December 31, 2021, and pay interest seminannually on July 1 and December 31.

Oct. 11 Sold all of the Thompson Company securities for $73,000 plus interest of $2,800.

Dec. 31 Received interest of $5,000 on the Stevens Company and Little Company debt securities, and the following yearend total market values were available: Stevens Company debt securities, $45,000; Little Company debt securities, $98,000.

Required:

1. Prepare journal entries to record the preceding information.

2. Next Level If Terry uses IFRS, how would the accounting for investments be different from U.S. GAAP?

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach