Cask Companys bookkeeper, who has maintained its accounting records since the companys formation in January 2017, has

Question:

Cask Company’s bookkeeper, who has maintained its accounting records since the company’s formation in January 2017, has prepared the unaudited financial statements. In your examination of these statements at the end of 2019, you discover the following items:

1. Sales taxes collected from customers have been included in the Sales account. The Sales Tax Expense account is debited when the sales taxes are remitted to the state in the month following the sale. All sales are subject to a 6% sales tax. Total sales (excluding sales tax) for the 3 years 2017 through 2019 were $200,000, $300,000, and $500,000, respectively. The Sales Tax Expense account balances for the 3 years were $10,000, $15,000, and $26,000, respectively.

2. An account payable of $15,000 for merchandise purchased in December 2017 was recorded in January 2018.

The merchandise was not included in inventory at December 31, 2017. Cask uses a periodic inventory system.

3. Merchandise with a cost of $4,000 was included twice in the December 31, 2018, inventory. Cask uses a periodic inventory system.

4. The company has used the direct write-off method of accounting for bad debts. Accounts written off in the 3 years 2017 through 2019 were $2,000, $4,500, and $6,500, respectively. The appropriate balances of Allowance for Doubtful Accounts at the end of 2017 through 2019 are $5,000, $6,000, and $8,200, respectively.

5. On January 1, 2018, 12%, 10-year bonds with a face value of $600,000 were issued at 102. The premium was credited to Additional Paid-in Capital. The bonds pay interest on June 30 and December 31, and use of the straight-line amortization method is appropriate.

6. Travel advances to the sales personnel of $18,000 were included as selling expenses for 2018. The travel occurred in 2019.

7. Salaries payable at the end of each year have not been accrued. Appropriate amounts at the end of 2017 through 2019 are $10,000, $11,000, and $7,000, respectively.

8. Installation, freight, and testing costs of $25,000 on a machine purchased in January 2017 were expensed at that time. The machine has a life of 5 years and a residual value of $10,000.

Required:

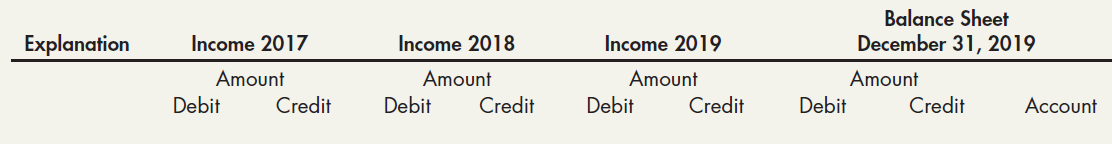

Analyze the effects of the errors on income for the 2017, 2018, and 2019 ending balance sheet (ignore income taxes), according to the following format:

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach