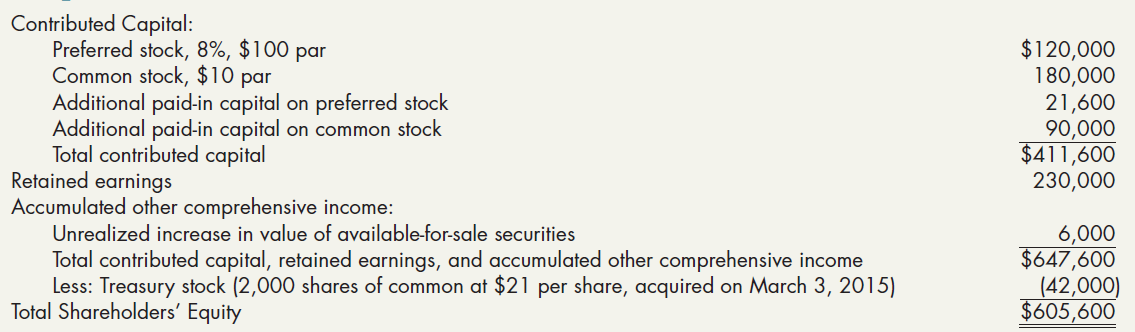

Gray Company lists the following shareholders equity items on its December 31, 2018, balance sheet: The following

Question:

Gray Company lists the following shareholders’ equity items on its December 31, 2018, balance sheet:

The following stock transactions occurred during 2019:

Jan. 4 Issued 3,000 shares of common stock at $25 per share.

30 Paid the annual 2015 per share dividend on preferred stock and the $2 per share dividend on common stock.

These dividends had been declared on December 31, 2018.

Mar. 2 Issued 400 shares of preferred stock at $125 per share.

May 7 Reissued 600 shares of treasury stock at $24 per share.

June 15 Split the common stock 2-for-1, reducing the par value to $5 per share.

July 2 Declared a 5% stock dividend on the outstanding common stock, to be issued on August 3. The stock is selling for $14 per share.

Aug. 3 Issued the stock dividend.

Oct. 1 Declared a property dividend payable to common shareholders on November 1. The dividend consists of 200 Lamb Company bonds that are classified as an available-for-sale investment. The bonds had been acquired at a cost of $24,000 and have a carrying value of $30,000. The bonds are currently selling for $32,000.

Nov. 1 Issued the property dividend to common shareholders.

Dec. 31 Declared the annual per share dividend on the outstanding preferred stock and a $1 per share dividend on the outstanding common stock, to be paid on January 30, 2020.

Required:

1. Prepare journal entries to record the preceding transactions.

2. Prepare the December 31, 2019, shareholders’ equity section (assume that 2019 net income was $225,000).

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach