In 2020, Frost Company, which began operations in 2018, decided to change from LIFO to FIFO because

Question:

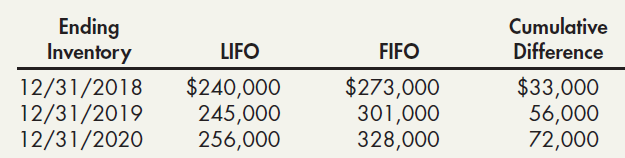

In 2020, Frost Company, which began operations in 2018, decided to change from LIFO to FIFO because management believed that FIFO better represented the flow of their inventory. Management prepared the following analysis showing the effect of this change:

Frost reported net income of $2,500,000, $2,400,000, and $2,100,000 in 2018, 2019, and 2020, respectively. The tax rate is 21%.

Required:

1. Prepare the journal entry necessary to record the change.

2. What amount of net income would Frost report in 2018, 2019, and 2020?

3. If Frost’s employees received a bonus of 10% of income before deducting the bonus and income taxes in 2018 and 2019, what would be the effect on net income for 2018, 2019, and 2020?

Ending Inventory Cumulative Difference LIFO FIFO $240,000 245,000 256,000 $273,000 301,000 328,000 $33,000 56,000 72,000 12/31/2018 12/31/2019 12/31/2020

Step by Step Answer:

1 Inventory 56000 Deferred Tax Liability 56000 21 11760 Retained Earnings 44240 2 2018 2019 2020 Rep...View the full answer

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Students also viewed these Business questions

-

Harris Company, which began operations in 2013, invests its idle cash in trading securities. The following transactions relate to its short- term investments in its trading securities. 2013 Mar. 10...

-

In 2017, Frost Company, which began operations in 2015, decided to change from LIFO to FIFO because management believed that FIFO better represented the flow of their inventory. Management prepared...

-

In 2014, Frost Company, which began operations in 2012, decided to change from LIFO to FIFO because management believed that FIFO better represented the flow of their inventory. Management prepared...

-

What responsibilities can a Crew Boss delegate to a subordinate supervisor? (Select all that apply) Re-supplying crew and equipment Communicating crew wake up time for next operational period...

-

Describe the effect of left or right multiplication by a matrix that is in the canonical form for nilpotent matrices.

-

Add or subtract as indicated. Give answers in standard form. [(7 + 3i)-(4-2i)] + (3 + i)

-

Thermal regeneration of a fixed-bed adsorber is based on the fact that the adsorption process is exothermic; therefore, heating the saturated adsorbent will result in desorption. The dynamics of the...

-

Thumbtacks March 31, 2012, budgeted balance sheet follows: The budget committee of Thumbtack Office Supply has assembled the following data. a. Sales in April were $40,000. You forecast that monthly...

-

The wave function associated with standing waves established in a 5.00 m long light-weight rope is y = 0.00300 sin(x)cos(110t) where x and y are in meters and t is in seconds. (a) How many...

-

Refer to Sections 203 and 206 of SARBOX. How would these sections of the law have impacted the Waste Management audit? Do you believe that these sections were needed? Why or why not?

-

Delta Oil Company uses the successful-efforts method to account for oil exploration costs. Delta started business in 2017 and prepared the following income statements: The company chooses to change...

-

Gundrum Company purchased equipment on January 1, 2015 for $850,000. The equipment was expected to have a useful life of 10 years and a salvage value of $30,000. Gundrum uses the straight-line method...

-

The number of defective components produced by a certain process in one day has a Poisson distribution with mean 20. Each defective component has probability 0.60 of being repairable. a. Find the...

-

Under Modigliani and Miller world, as the CEO of company, when you decided to distribute 1 Billion dollar cash, one of your shareholders, Mr. A, who purchased the stock on the ex-date, raised a...

-

Company XYZ conducts treasury futures arbitrage. Information pertinent to the T-bond futures and the underlying bonds are shown below. Current date & repo rate: May 25, 2021, repo rate = 10% per...

-

Icelantic manufactures and sells Colorado-made skis. The firm wants to produce a limited edition of skis to celelbrate Golden Colorado. The firm estimates that the fixed cost of producing this batch...

-

Suppose only one professor teaches economics at your university. Would you say that this professor is a monopolist who can exact any price from students in the form of readings assigned, tests given,...

-

How many years will it take $750 to grow to $1500 if the annual interest rate is 3.5% compounded semi-annually? You must use your financial calculator or no credit. You must show the sequence and all...

-

You have joined your friends at the local watering hole, The Tombs, for your weekly debate on international finance. The topic this week is whether the cost of equity can ever be cheaper than the...

-

Show, if u(x, y) and v(x, y) are harmonic functions, that u + v must be a harmonic function but that uv need not be a harmonic function. Is e"e" a harmonic function?

-

You have been asked by a client to review the records of Roberts Company, a small manufacturer of precision tools and machines. Your client is interested in buying the business, and arrangements have...

-

Cullen Construction Company, which began operations in 2025, changed from the cost-recovery to the percentage-of-completion method of accounting for long-term construction contracts during 2026. For...

-

At the beginning of 2025, Wertz Construction Company changed from the cost- recovery method to recognizing revenue over time (percentage-of-completion) for financial reporting purposes. The company...

-

The figure below shows five resistors and two batteries connected in a circuit. What are the currents 11, 12, and 13? (Consider the following values: R = 1.080, R = 2.14 Q, R3 = 3.01 Q, R4 = 4.16 Q,...

-

2 Determine the magnitude of the moment (in N.m) produced by the force Fabout point A. Consider F = - F -42 +36 +27 N, 0 = 20 degrees, and AB = 4.5 m. Determine the moment (in N.m) produced by the...

-

Determine the resultant moment (in kN.m) about point A in the structure. Consider F=3.5 kN, 0= 20 degrees, and a = 5 m. Consider CCW direction as the positive direction for the moment. 8 kN 3 5 -4m B...

Study smarter with the SolutionInn App