Information for Blake Corporations property, plant, and equipment for 2019 is: Depreciation Method and Useful Life Building:

Question:

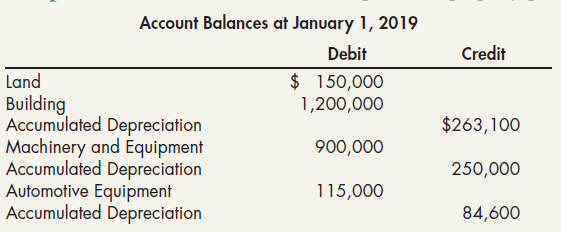

Information for Blake Corporation’s property, plant, and equipment for 2019 is:

Depreciation Method and Useful Life

Building: 150%-declining-balance; 25 years.

Machinery and equipment: Straight-line; 10 years.

Automotive equipment: Sum-of-the-years’-digits; 4 years.

Leasehold improvements: Straight-line.

The residual value of the depreciable assets is immaterial.

Depreciation is computed to the nearest month.

Transactions during 2019 and other information were as follows:

a. On January 2, 2019, Blake purchased a new car for $10,000 cash and a trade-in of a 2-year-old car with a cost of $9,000 and a book value of $2,700. The new car has a cash price of $12,000; the market value of the trade-in is not known.

b. On April 1, 2019, a machine purchased for $23,000 on April 1, 2014, was destroyed by fire. Blake recovered $15,500 from its insurance company.

c. On May 1, 2019, costs of $168,000 were incurred to improve leased office premises. The leasehold improvements have a useful life of 8 years. The related lease, which terminates on December 31, 2025, is renewable for an additional 6-year term. The decision to renew will be made in 2025 based on office space needs at that time.

d. On July 1, 2019, machinery and equipment were purchased at a total invoice cost of $280,000; additional costs of $5,000 for freight and $25,000 for installation were incurred.

e. Blake determined that the automotive equipment comprising the $115,000 balance at January 1, 2019, would have been depreciated at a total amount of $18,000 for the year ended December 31, 2019.

Required:

1. For each asset classification, prepare schedules showing depreciation and amortization expense, and accumulated depreciation and amortization that would appear on Blake’s income statement for the year ended December 31, 2019, and on the balance sheet at December 31, 2019, respectively.

2. Prepare a schedule showing the gain or loss from disposal of assets that would appear in Blake’s income statement for the year ended December 31, 2019.

3. Prepare the property, plant, and equipment section of Blake’s December 31, 2019, balance sheet.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach