Jorg is building an office building for Wilmington Company for $20,000,000. The contract has the following characteristics:

Question:

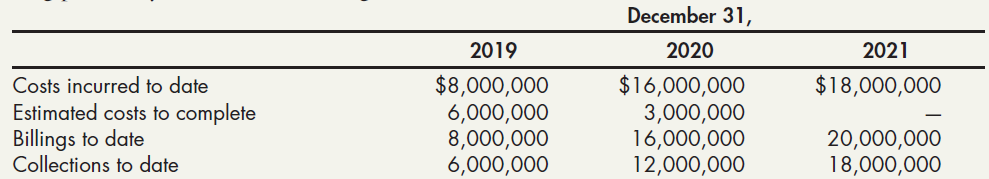

Jorg is building an office building for Wilmington Company for $20,000,000. The contract has the following characteristics:

• The office building is built to the customer’s specifications and the customer can make changes to these specifications over the contract term.

• Progress payments are made by the customer throughout construction.

• The customer can cancel the contract at any time (with a termination penalty); any work in process is the property of the customer. Jorg provides you with the following details:

Required:

1. Calculate the estimated total gross profit on the contract as of December 31, 2019, 2020, and 2021.

2. Calculate the percentage of completion for 2019, 2020, and 2021.

3. Calculate the amount of income (loss) Jorg will recognize for 2019, 2020, and 2021.

4. Prepare all journal entries related to this project for Jorg for all 3 years.

5. How will this project be carried on the balance sheet for 2019, 2020, and 2021?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach