Lane Company was incorporated in 2004. Because it had become successful, Lane established a defined benefit pension

Question:

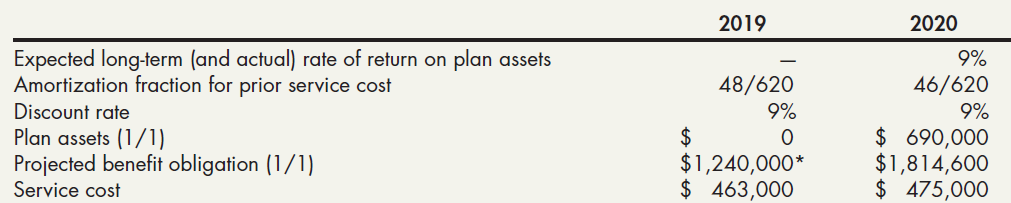

Lane Company was incorporated in 2004. Because it had become successful, Lane established a defined benefit pension plan for its employees on January 1, 2019. Due to the loyalty of its employees, Lane granted retroactive benefits to them. These retroactive benefits resulted in $1,240,000 of prior service cost on that date. Lane decided to amortize this cost using the years-of-future-service method. Lane’s actuary and funding agency have provided the following additional information for 2019 and 2020:

Lane contributed $690,000 and $660,000 to the pension fund at the end of 2019 and 2020, respectively. No retirement benefits were paid in 2019 or 2020. There are no other components of Lane’s pension expense. At the end of 2020, the projected benefit obligation was $2,452,914 and the fair value of the pension plan assets was $1,412,100.

Required:

1. Compute the amount of Lane’s pension expense for 2019 and 2020.

2. Prepare all the journal entries related to Lane’s pension plan for 2019 and 2020.

3. What is the total accrued/prepaid pension cost at the end of 2020? Is it an asset or a liability?

4. Prepare a schedule that reconciles the beginning and ending amounts of the projected benefit obligation for 2020.

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach