Oliver Company earned taxable income of $7,500 during 2019, its first year of operations. A reconciliation of

Question:

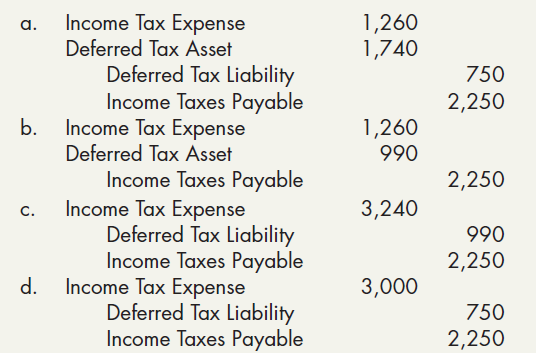

Oliver Company earned taxable income of $7,500 during 2019, its first year of operations. A reconciliation of pretax financial income and taxable income indicated that an additional $2,500 of accelerated depreciation was deducted for tax purposes and that an estimated expense of $5,800 was deducted for financial reporting purposes. The estimated expense is not expected to be deductible for tax purposes until 2022, when the liability is paid. The current tax rate is 30%, and no change in the tax rate has been enacted for future years. The resulting journal entry for 2019 would be:

Income Tax Expense Deferred Tax Asset Deferred Tax Liability Income Taxes Payable Income Tax Expense Deferred Tax Asset Income Taxes Payable Income Tax Expense Deferred Tax Liability Income Taxes Payable Income Tax Expense Deferred Tax Liability Income Taxes Payable 1,260 1,740 a. 750 2,250 b. 1,260 990 2,250 3,240 C. 990 2,250 d. 3,000 750 2,250

Step by Step Answer:

a a Income Tax Expen...View the full answer

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Multiple choice questions 1. Which of the following is not a cause of a difference between pretax financial income and taxable income in a given period? a. Operating loss carrybacks and carryforwards...

-

Multiple Choice 1. A permanent difference is a difference between pretax financial income and taxable income in an accounting period that will never reverse in a later period. Which of the following...

-

Pito Company has been in operation for several years. During those years the company has been profitable, and it expects to continue to be profitable in the foreseeable future. At the beginning of...

-

Suppose an economy is at full-employment equilibrium at a GDP of $25 billion and investment declines by $4 billion. According to Keynes, this economy will: OA. Quickly self adjust back to full...

-

Peggy drives from Cornwall to Atkins Glen in 45 min. Cornwall is 73.6 km from Illium in a direction 25west of south. Atkins Glen is 27.2 km from Illium in a direction 15south of west. Using Illium as...

-

Divide. (2x + 3x5) + (x - 1)

-

On February 20, 2009, Cedar Valley Aviation, a wholly owned subsidiary of Aerial Services, Inc. (ASI), brought a Piper 522AS (Cheyenne II) in for maintenance to Des Moines Flying Service, Inc....

-

Clampett Oil purchases crude oil products from suppliers in Texas (TX), Oklahoma (OK), Pennsylvania (PA), and Alabama (AL), from which it refines four end-products: gasoline, kerosene, heating oil,...

-

Let n and m be positive integers with n m 1. (a) (9 points) How many different m-word sentences can be constructed using an al- phabet of n letters where each of the letters appears exactly once? A...

-

Determine the moment of inertia of the thin plate about an axis perpendicular to the page and passing through the pin at O. The plate has a hole in its center. Its thickness is c, and the material...

-

At the beginning of 2019, Conley Company purchased an asset at a cost of $10,000. For financial reporting purposes, the asset has a 4-year life with no residual value and is depreciated by the...

-

In 2019, Swope Company reports a pretax operating loss of $100,000 for both financial reporting and income tax purposes. Swope concludes that the operating loss in 2019 is temporary and that the...

-

What will be the result if we conclude that the mean is 45 when the actual mean is 50? (i) We have made a type I error. (ii) We have made a type II error. (iii) We have made the correct decision....

-

CVS Health has taken a yen future position to hedge a 125 million yen account payable at a yen futures price of 0.00928$/yen. As you know, yen futures are quoted to six decimal places, and each yen...

-

Rather than raising money through debt or equity, your CEO suggests cutting dividends to $2.50 next year to finance the project. This would save the company 800,000 * $2.50 = $2 million, fully...

-

A project has an initial cost of $157,500 and produces cash inflows of $60,300, $72,900, and $85,500 over three years, respectively. What is the discounted payback period if the required rate of...

-

Capital adjustments for a share are described below. The last sale price is immediately after the shares have gone "ex" the event described in the final column. For example, the price of $18.00 at...

-

A charge Q = 15.5 nC is located at the origin. What is the magnitude of the electric field created by this charge at a point of coordinates x = 4.5 m and y = 2.4 m? Round off your answer to 2 decimal...

-

1. According to the UCC, if delivered goods do not conform to a sales contract, how can the buyer revoke acceptance? 2. In this case, what was the dispute between the buyer and the seller? How did...

-

The production budget of Artest Company calls for 80,000 units to be produced. If it takes 30 minutes to make one unit and the direct labor rate is $16 per hour, what is the total budgeted direct...

-

What is a counterbalancing error? Describe two errors that are note counterbalanced in the following period.

-

What steps are necessary to apply the retrospective adjustment method?

-

Does the adoption of a new accounting principle for events or transactions occurring for the first time represent a change in accounting principle?

-

During Year 3, Jordan Corporation reported after-tax net income of $3,580,000. During the year, the number of shares of stock outstanding remained constant at 10,000 of $100 par, 10 percent preferred...

-

XYZ is a company based in Pune that offers financial courses to students. It has a system which has trading screens so people can learn using live markets. Its system and financial courses will be...

-

what ways do supranational organizations such as the World Trade Organization (WTO) shape and regulate the global economic landscape, and what are the implications for national sovereignty?

Study smarter with the SolutionInn App