On January 1, 2019, Parkway Company adopted a defined benefit pension plan. At that time, Parkway awarded

Question:

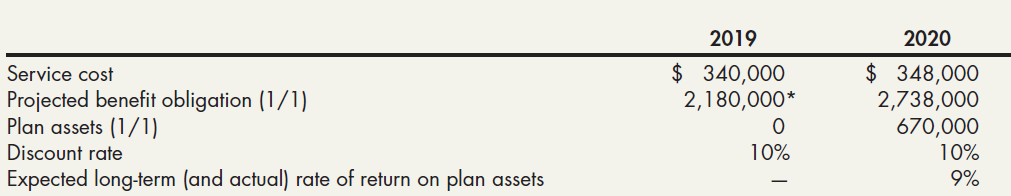

On January 1, 2019, Parkway Company adopted a defined benefit pension plan. At that time, Parkway awarded retroactive benefits to its employees, resulting in a prior service cost of $2,180,000 on that date (which it did not fund). Parkway decided to amortize this cost by the straight-line method over the 16-year average remaining service life of its active participating employees. Parkway’s actuary and funding agency have also provided the following additional information for 2019 and 2020:

Parkway contributed $670,000 and $700,000 to the pension fund at the end of 2019 and 2020, respectively. There are no other components of Parkway’s pension expense. At the end of 2020, the projected benefit obligation was $3,359,800 and the fair value of the pension plan assets was $1,430,300.

Required:

1. Compute the amount of Parkway’s pension expense for 2019 and 2020.

2. Prepare all the journal entries related to Parkway’s pension plan for 2019 and 2020.

3. What is the total accrued/prepaid pension cost at the end of 2020? Is it an asset or a liability?

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach