On January 2, 2019, Lapar Corporation purchased a machine for $50,000. Lapar paid shipping expenses of $500,

Question:

On January 2, 2019, Lapar Corporation purchased a machine for $50,000. Lapar paid shipping expenses of $500, as well as installation costs of $1,200. The company estimated that the machine would have a useful life of 10 years and a residual value of $3,000. On January 1, 2020, Lapar made additions costing $3,600 to the machine in order to comply with pollution-control ordinances. These additions neither prolonged the life of the machine nor increased the residual value.

Required:

1. If Lapar records depreciation expense under the straight-line method, how much is the depreciation expense for 2020?

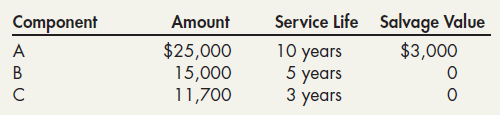

2. Assume Lapar determines the machine has three significant components as shown below.

If Lapar uses IFRS, what is the amount of depreciation expense that would be recorded?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach