Peterson Company has computed its pretax financial income to be $66,000 in 2019 after including the effects

Question:

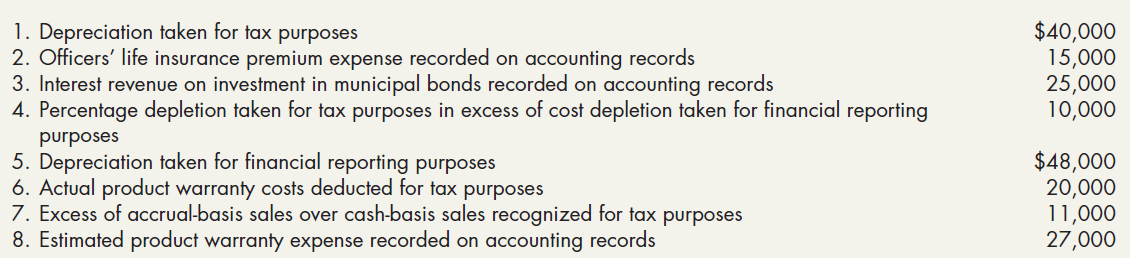

Peterson Company has computed its pretax financial income to be $66,000 in 2019 after including the effects of the appropriate items from the following information:

Peterson’s accountant has prepared the following schedule showing the future taxable and deductible amounts at the end of 2019 for its three temporary differences:

.....................................................................................Totals

Future Taxable Amounts

Depreciation difference .........................................$33,800

Accrual-basis vs. cash-basis excess .......................26,700

Future Deductible Amounts

Warranty difference ................................................56,500

At the beginning of 2019, Peterson had a deferred tax liability of $12,540 related to the depreciation difference and $4,710 related to the accrual-basis sales difference. In addition, it had a deferred tax asset of $14,850 related to the warranty difference. The current tax rate is 30%, and no change in the tax rate has been enacted for future years.

Required:

1. Compute Peterson’s taxable income for 2019.

2. Prepare Peterson’s income tax journal entry for 2019 (assume no valuation allowance is necessary).

3. Next Level Identify the permanent differences in Items 1 through 8 and explain why you did or did not account for them as deferred tax items in Requirement 2.

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach