The following items were derived from Woodbine Circle Corporations adjusted trial balance on December 31, 2019: Other

Question:

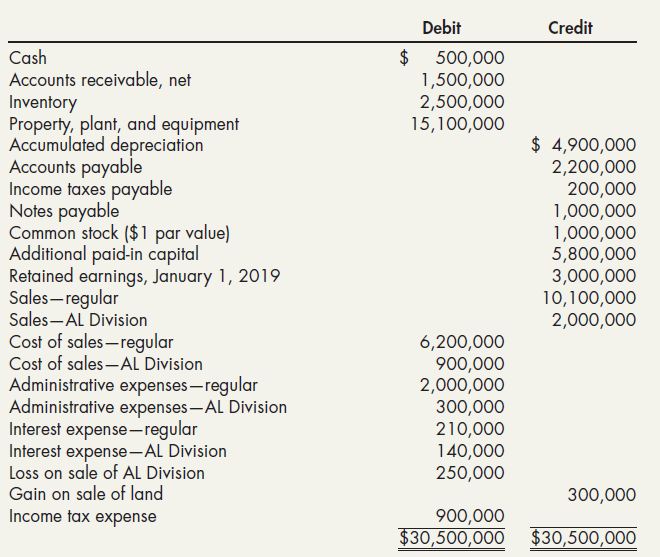

The following items were derived from Woodbine Circle Corporation’s adjusted trial balance on December 31, 2019:

Other financial data for the year ended December 31, 2019:

Federal Income Taxes

Paid with federal income tax return.................................$700,000

Accrued.................................................................................200,000

Total income tax expense (estimated).............................$900,000

Tax rate on all types of taxable income..............................40%

Discontinued Operations

On September 30, 2019, Woodbine sold its Auto Leasing (AL) Division for $4,000,000. The book value of this division was $4,250,000 at that date. For financial statement purposes, this sale was considered as a discontinued operation of a component of the company.

Capital Structure

Common stock, par value $1 per share. Number of shares outstanding during all of 2019 .............................1,000,000

Required:

Using the multiple-step format, prepare a formal income statement for Woodbine for the year ended December 31, 2019, together with the appropriate supporting schedules. All income taxes should be appropriately shown.

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach