A large piece of equipment acquired on 1 January 20X5 by Kapadia Company has four major components

Question:

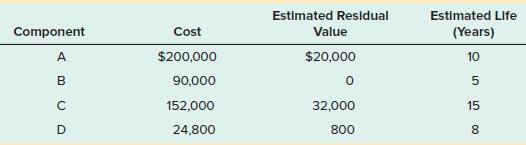

A large piece of equipment acquired on 1 January 20X5 by Kapadia Company has four major components for depreciation. Details regarding each component are given in the schedule below:

Required:

1. Calculate the depreciation for 20X5. Use the straight line method, and one accumulated depreciation account for all components. Give the entry to record depreciation after one full year of use.

2. At the end of 20X6, it was necessary to replace component B, which was sold for $24,000. The replacement component cost $100,000 and will have an estimated residual value of $10,000 at the end of its estimated five year useful life. Record the disposal and substitution, which was a cash acquisition.

3. Assume that the original machine was depreciated as a whole on a straight line basis over 15 years with no residual value, and not broken into components. Provide the requested information in requirement 1.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick