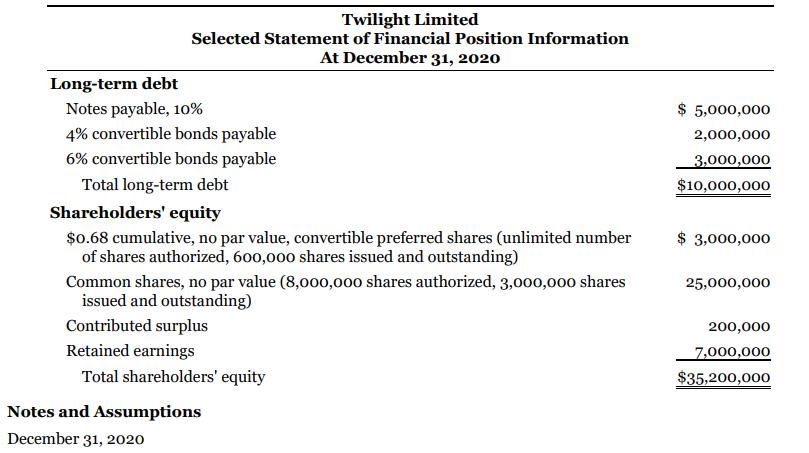

An excerpt from the statement of financial position of Twilight Limited follows: 1. Options were granted/written in

Question:

An excerpt from the statement of financial position of Twilight Limited follows:

1. Options were granted/written in 2019 that give the holder the right to purchase 100,000 common shares at $8 per share. The average market price of the company's common shares during 2020 was $14 per share. The options expire in 2028 and no options were exercised in 2020.

2. The 4% bonds were issued in 2019 at face value. The 6% bonds were issued on June 1, 2020, at face value. Each bond has a face value of $1,000 and is convertible into 100 common shares.

3. The convertible preferred shares were issued at the beginning of 2020. Each preferred share is convertible into one common share. 4. The average income tax rate is 25%.

5. The common shares were outstanding during the entire year.

6. Preferred dividends were not declared in 2020.

7. Net income was $2.5 million in 2020. 8. No bonds or preferred shares were converted during 2020.

Instructions

a. Calculate basic earnings per share for 2020. Round to the nearest cent.

b. Calculate diluted earnings per share for 2020. Round to the nearest cent. For simplicity, ignore the requirement to record the debt and equity components of the bonds separately. Use the three-step process in arriving at your answers. Describe each step as you proceed to the final answer.

c. From the perspective of a common shareholder, provide support for the treatment of the preferred dividends in calculating Twilight Limited's basic and diluted earnings per share.

d. Discuss how a potential shareholder's investment decision might be affected if diluted earnings per share was not reported.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy