Delmar Manufacturing Inc. is a manufacturer of electronics. It has been in operation for over 25 years

Question:

Delmar Manufacturing Inc. is a manufacturer of electronics. It has been in operation for over 25 years under ownership of the same two private shareholders. It has always offered its employees a very generous defined benefit (DB) pension plan as part of the compensation package. Delmar has recently undergone expansion, and in the last quarter of this fiscal year (2020), it opened a new manufacturing plant. As a result, it also created a new DB pension plan for the employees of the new plant. Some of the employees at the new plant are current employees who were already participating in the existing DB pension plan and others are recently hired employees and will be new to Delmar's pension plan. Existing employees were transferred into the new plan before the end of the fiscal year.

A review of the pension transactions for 2020 revealed the following:

1. For 2020, the service cost for Delmar employees is projected by the actuary to be $236,000. The current service cost is credited at the end of each fiscal year. Nothing has been recorded in the financials to reflect this.

2. The actuary has reviewed the new plan and determined that the past service costs for existing employees is $96,000 (a cumulative total over the past 20 years). Delmar has not yet reflected this in its current results and is unclear on how to accurately reflect this in its financial statements. Delmar employees would be eligible for full benefits after a one-year vesting period.

3. Delmar's current borrowing rate and settlement rate is 7%. Delmar's management has specifically ruled out the option of purchasing an insurance contract for the future settlement of its pension liability. The current interest rate on high-quality corporate bonds is 8%.

4. The plan paid only $34,000 in benefits to its retirees for 2020 and Delmar contributed $88,000 to the plan throughout the year.

5. Due to declining economic conditions, the actuary has revised its assumptions for age of retirement and final salary. This has resulted in an actuarial loss of $55,000. Delmar must also account for an actuarial loss of $19,000 resulting from differences in past assumptions and actual costs (experience losses). This has not yet been accounted for in the statements.

6. The actual return on plan assets was $16,500, significantly lower than projected.

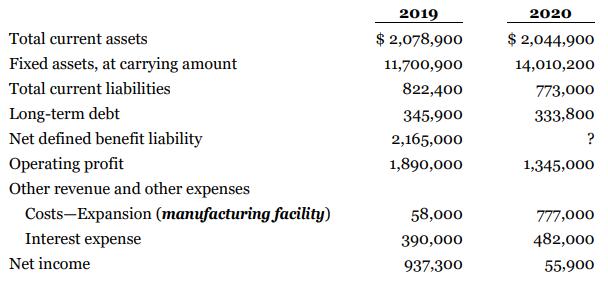

7. The defined benefit obligation as determined by the actuarial valuation is the defined benefit obligation used for accounting purposes. The fair value of the plan assets was $980,000 at the end of 2019. Excerpts from Delmar's financial statements are provided below, prepared under ASPE.

Instructions

Delmar Manufacturing Inc.'s management is reviewing its current pension accounting in preparation for an upcoming meeting with the board of directors and its pension committee. Complete the calculations needed to record the ending net defined benefit liability or asset. In addition, assume the role of a consultant and discuss the financial reporting issues, particularly the implications for the financial statements and the differences in reporting and presentation if the company moved to IFRS. Provide guidance on which method would be preferable for Delmar.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy