Diagnostics Corp. follows IFRS and sells its products in expensive, reusable containers that can be tracked. The

Question:

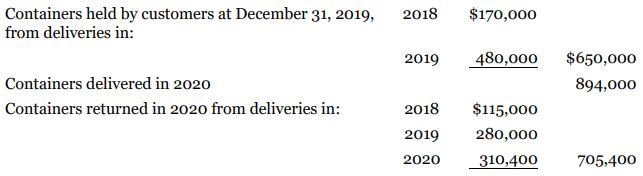

Diagnostics Corp. follows IFRS and sells its products in expensive, reusable containers that can be tracked. The customer is charged a deposit for each container that is delivered and receives a refund for each container that is returned within two years after the year of delivery. When a container is not returned within the time limit, Diagnostics accounts for the container as being sold at the deposit amount and credits the account Container Sales Revenue. Information for 2020 is as follows:

Instructions

a. Prepare all journal entries required for Diagnostics Corp. for the returnable deposits during 2020. Use the account Refund Liability.

b. Calculate the total amount that Diagnostics should report as a liability for returnable deposits at December 31, 2020.

c. Should the liability calculated in part (b) be reported as current or long-term? Explain.

d. Had Diagnostics followed ASPE, would any of your answers in parts (a) to (c) be different?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy