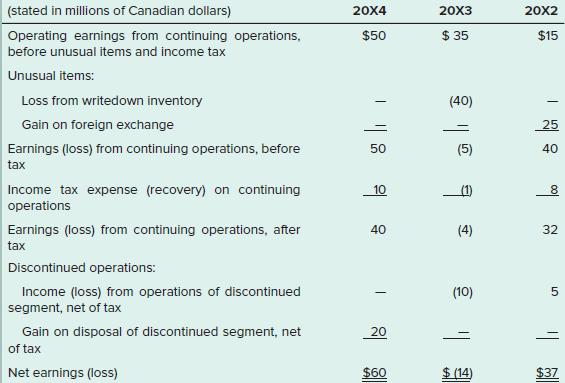

Excerpts from the statements of comprehensive income for Wild Adventures Ltd. for the years 20X2 through 20X4

Question:

Excerpts from the statements of comprehensive income for Wild Adventures Ltd. for the years 20X2 through 20X4 are as follows:

Required:

1. Wild has experienced volatile earnings over the three year period shown. Do you expect this to continue? Why or why not?

2. Net earnings increased from a loss of $14 million in 20X3 to a profit of $60 million in 20X4, a very substantial increase. Suppose the company’s common share price increased only approximately 20% during the same period. Why might this be the case? Relate the 20% increase in share price to the components of net income.

3. Would you expect net income in 20X5 to be more or less than the amount reported in 20X4? More specifically, assuming no new unusual, nonrecurring items, what amount would you estimate net income to be in 20X5?

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick