For the past three years, Bonafacio Holdings Ltd. has held bonds as investments, which it accounted for

Question:

For the past three years, Bonafacio Holdings Ltd. has held bonds as investments, which it accounted for using the amortized cost model. The bonds were purchased at a discount and are currently classified as Bond Investment at Amortized Cost. There have been no disposals of bonds since the purchase in early 2018.

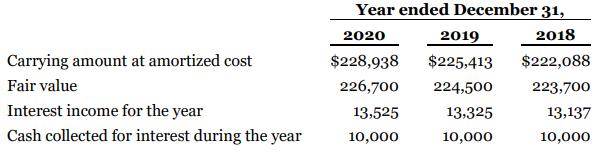

Due in part to Bonafacio's liquidity needs, and the recent market rate of interest increases, Bonafacio has changed its plans concerning holding the bonds as fixed income. It now feels unwilling to wait for the bonds' maturity date to collect the proceeds from the maturity. Consequently, it was decided in December 2020 that the bonds should instead be accounted for as FV-NI Investments. Bonafacio follows IFRS. The carrying amount and fair value of the investment portfolio of bonds appears below, along with the interest income recorded in the accounts:

Instructions

a. Identify the type of accounting change that is described and whether prior years' financial statements need to be adjusted retroactively.

b. Would your answer in part (a) change if Bonafacio followed ASPE?

c. Prepare any necessary journal entry at December 31, 2020, based on your conclusions in part (a).

d. Prepare the comparative SFP presentation of the investment at December 31, 2020 and 2019, if Bonafacio had not made the change.

e. Prepare the comparative SFP presentation of the investment at December 31, 2020 and 2019, including the implementation of the change.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy