Four independent situations follow: 1. On March 1, 2020, Wilkie Inc. issued $4 million of 9% bonds

Question:

Four independent situations follow:

1. On March 1, 2020, Wilkie Inc. issued $4 million of 9% bonds at 103 plus accrued interest. The bonds are dated January 1, 2020, and pay interest semi-annually on July 1 and January 1. In addition, Wilkie incurred $27,000 of bond issuance costs.

2. On January 1, 2020, Langley Ltd. issued 9% bonds with a face value of $500,000 for $469,280 to yield 10%. The bonds are dated January 1, 2020, and pay interest annually. Langley prepares financial statements in accordance with ASPE.

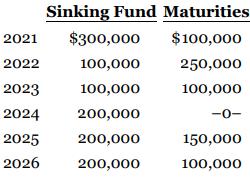

3. Chico Building Inc., a private company that prepares financial statements in accordance with ASPE, has several long-term bonds outstanding at December 31, 2020. These long-term bonds have the following sinking fund requirements and maturities for the next six years:

4. In the long-term debt structure of Czeslaw Inc., the following three bonds were reported: mortgage bonds payable, $10 million; collateral trust bonds, $5 million; and bonds maturing in installments, secured by plant equipment, $4 million.

Instructions

a. For situation 1, calculate the net amount of cash received by Wilkie as a result of the issuance of these bonds.

b. For situation 2, what amount should Langley report for interest expense in 2020 related to these bonds, assuming that it uses the effective interest method for amortizing any bond premium or discount? Could Langley choose to use the straight-line method for amortizing any bond premium or discount?

c. For situation 3, indicate how this information should be reported in Chico's financial statements at December 31, 2020.

d. For situation 4, determine the total amount of debenture bonds that is outstanding, if any.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy