Grand Ltd. is a Canadian company that had the following transactions in 20X7: a. Sold goods to

Question:

Grand Ltd. is a Canadian company that had the following transactions in 20X7:

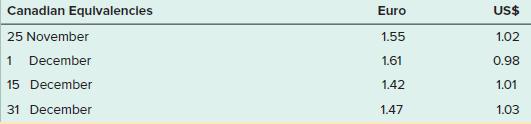

a. Sold goods to a customer in Belgium on 25 November for 220,000 euros.

b. Sold goods to a U.S. customer on 25 November for US $80,000.

c. Sold goods on 1 December, to a British customer for 140,000 euros.

d. On 15 December, the customer in transaction (a) paid.

At year end, the other two accounts receivable were still outstanding.

Required:

Calculate the exchange gain or loss to be reported in 20X7, the accounts receivable on the 31 December 20X7 statement of financial position, and the sales revenue to be recorded from the transactions listed above.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick