I cannot believe you have advised against an employee bonus this year, exclaimed Jessica Simpson, senior accountant

Question:

“I cannot believe you have advised against an employee bonus this year,” exclaimed Jessica Simpson, senior accountant of Glowworm Inc. (GI), as she stormed into the office of the GI chief financial officer on Monday morning. GI is a large, privately owned manufacturing firm that reports in accordance with ASPE.

The CFO replied, “GI pays bonuses only when earnings before income tax exceed $1,000,000. Upon reviewing your draft income statement for the year ending 31 December 20X6, I was required to make several adjustments that reduced earnings before income taxes to $925,000. I am sorry Jessica; however, we cannot ignore GAAP!”

Required

Analyze the accounting issues presented in Exhibit 1 and, based on your conclusions, settle the argument between Jessica and the CFO.

EXHIBIT 1

GLOWWORM INC.

Additional information

Jessica’s draft income statement reported earnings before tax of $1,220,000 and took into account the following issues:

1. GI’s office building is located in a very “up and coming” location. Property values have been rising steadily and this trend is expected to continue. An independent appraisal recently appraised the building and found that the value has doubled since it was acquired by GI. Jessica decided that reporting the building at a net book value that is less than the prior years’ does not represent the economic reality of the situation. Therefore, she reversed the depreciation expense that had previously been recorded for 20X6:

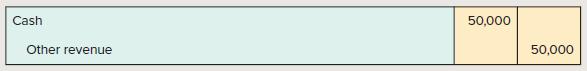

2. In January 20X6, GI received funding from the federal government for purposes of upgrading equipment to meet a higher standard of environmental responsibility. This grant of $50,000 was recorded in the accounts as follows:

The equipment, which cost $100,000 and has a useful life of 7 years, required GI to install a special platform for the equipment to sit on. The platform, which cost $13,000, was capitalized with the equipment. Due to the large size of the new equipment, existing equipment had to be removed and reinstalled in another area of the plant, which cost $6,000 and was expensed in the financial statements.

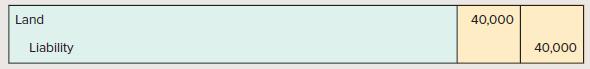

3. In late 20X5, a building that was no longer in use by GI was demolished. In early 20X6, the town started a petition calling for GI to clean up the land in order to maintain the beauty of the town and comply with community bylaws. Based on advice from a lawyer and to please the town citizens, GI made a public promise in early 20X6 to clean up and landscape the land by the end of fiscal 20X17. The estimated cost will be $40,000. This was reported in the financial statements as follows:

No additional journal entries were recorded in relation to this situation.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick