Loschiavo Ltd. (LL) has a 31 December fiscal year end. LL disposed of its Computer Programming Group

Question:

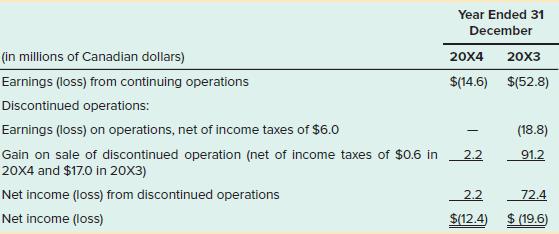

Loschiavo Ltd. (LL) has a 31 December fiscal year end. LL disposed of its Computer Programming Group (CPG) on 31 July 20X3. CPG had a net loss (after taxes) of $18,850,000 in 20X3, to the date of disposal. The division was sold for $237,800,000 in cash plus future royalties through 31 May 20X4, which were guaranteed to be $10,000,000. The minimum guaranteed royalties were included in the computation of the 20X3 gain on the sale of the division. Actual royalties received in 20X4 were $15,000,000. Excerpts from comparative income statements found in the 31 December 20X4 financial statements are as follows:

Required:

1. Determine the net book value of CPG at the date of disposal.

2. Why does LL report a gain on the sale of the discontinued operation of $2.2 million in the year ending 31 December 20X4?

3. LL reports an after tax loss from discontinued operations of $18.8 million for the year ending 31 December 20X3. Over what period was the loss accrued?

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick