Mustafa Limited began operations on January 2, 2019. Mustafa employs nine individuals who work eight-hour days and

Question:

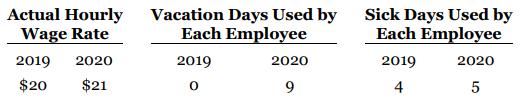

Mustafa Limited began operations on January 2, 2019. Mustafa employs nine individuals who work eight-hour days and are paid hourly. Each employee earns 10 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows:

Mustafa Limited has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when they are earned and to accrue sick pay when it is earned. For the purpose of this question, ignore any tax, CPP, and EI deductions when making payments to the employees.

Instructions

a. Prepare the journal entries to record the transactions related to vacation entitlement during 2019 and 2020.

b. Prepare the journal entries to record the transactions related to sick days during 2019 and 2020.

c. Calculate the amounts of any liability for vacation pay and sick days that should be reported on the SFP at December 31, 2019 and 2020.

d. How would your answers to parts (b) and (c) change if the entitlement to sick days did not accumulate?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy