On 1 January 20X5, Zan Company purchased 5,000 of the 20,000 outstanding common shares of Woo Computer

Question:

On 1 January 20X5, Zan Company purchased 5,000 of the 20,000 outstanding common shares of Woo Computer Corp. (WC) for $120,000 cash. Zan had significant influence as a result of the investment and will use the equity method to account for the investment.

On 1 January 20X5, the statement of financial position of WC showed the following book values (summarized):

Assets not subject to depreciation ..................................... $150,000*

Assets subject to depreciation (net) ................................... 120,000**

Liabilities ................................................................................ 40,000

Common shares .................................................................. 180,000

Retained earnings ................................................................ 50,000

*Fair value, $170,000; difference relates to land.

**Fair value, $140,000, estimated remaining life, 5 years.

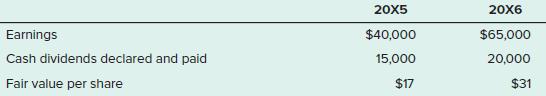

Assume there is no impairment of goodwill. Additional subsequent data on WC are as follows:

Required:

1. Provide the investor’s entries or give the required information for:

a. Entry at date of acquisition.

b. Amount of goodwill purchased.

c. Entries at 31 December 20X5 to recognize investment revenue and dividends.

d. Entries at 31 December 20X6 to recognize investment revenue and dividends.

2. Are any entries needed to recognize a writedown to fair value at the end of 20X5 or 20X6? Explain.

3. Reconstruct the investment account, showing the opening and closing balances and all changes in the account.

4. How much investment revenue would be reported each year if the cost method was used? What would be the balance in the investment account

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick