Pace Instrument Corp., a small company that follows ASPE, began operations on January 1, 2017, and uses

Question:

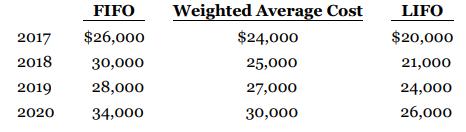

Pace Instrument Corp., a small company that follows ASPE, began operations on January 1, 2017, and uses a periodic inventory system. The following net income amounts were calculated for Pace under three different inventory cost formulas:

Instructions

Answer the following, ignoring income tax considerations.

a. Assume that in 2020, Pace changed from the weighted average cost formula to the FIFO cost formula and it was agreed that the FIFO method provided more relevant financial statement information. Prepare the necessary journal entry for the change that took place during 2020, and provide all the information that is needed for reporting on a comparative basis.

b. Assume that in 2020, Pace, which had been using the LIFO method since incorporation in 2017, changed to the FIFO cost formula in order to comply with CPA Canada Handbook, Part II, Section 3031, because LIFO is not a permitted inventory cost flow assumption under GAAP. The company applies the new policy retrospectively.

Prepare the necessary journal entry for the change, and provide all the information that is needed for reporting on a comparative basis.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy