Princely Entertainment Ltd. (PEL) is an interactive entertainment company for the mobile world. Frank Prince and his

Question:

Princely Entertainment Ltd. (PEL) is an interactive entertainment company for the mobile world. Frank Prince and his family members own the majority of the 4,000 shares, and have financed all growth through shareholder loans, equity investment, and retained earnings; lenders, historically, have been hesitant to become involved in this sector.

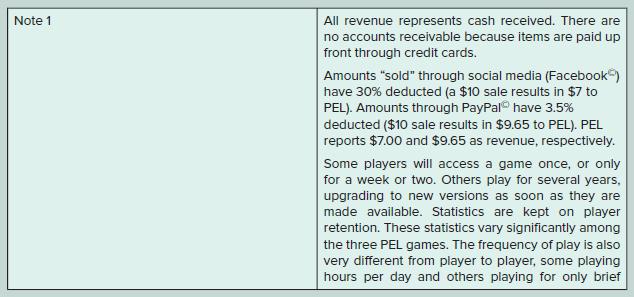

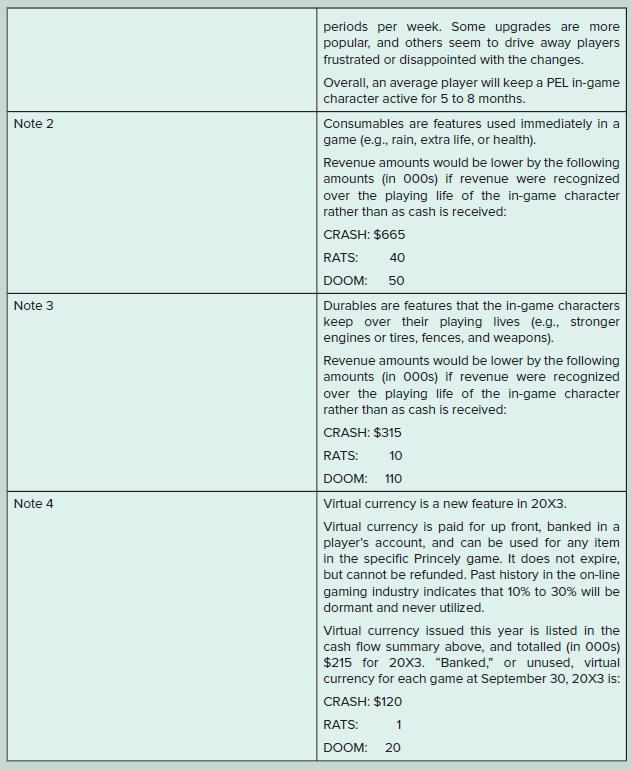

Currently, the company has three games it has developed and currently sells: Princely CRASH, Princely RATS, and Princely DOOM. Users access PEL games for free via their mobile devices and through social networks. PEL generates revenue primarily through sales of virtual items that can be used in the games, such as extra lives, boosters, and game content that enhance users’ entertainment experience. Princely CRASH has experienced viral growth in the past year, changing PEL from a marginal, home grown company into an entity with far more potential. Frank is coming to understand that his company might be a takeover target for one of the larger players in this business, or even have the potential to go public itself if growth continues. PEL would require far more volume and breadth of games for a public offering to be feasible, however. You, CPA, have just been hired as the first ever professional accounting member of PEL’s management team. You are VP Finance, but your position involves many different elements. The financial records have primarily been kept on a cash basis, but because of growth, Frank thinks it is time to revisit accounting policies and start getting audited statements that comply with ASPE or perhaps IFRS.

All revenue is received through direct deposit from Facebook© and PayPal©. Frank’s wife, Ethel, keeps the accounting records, and is known for her attention to detail. Payroll is handled by a third party service. Ethel prepares simple monthly financial statements for Frank based on cash received and paid. Unpaid bills are accrued at year end for the preparation of the annual financial statements.

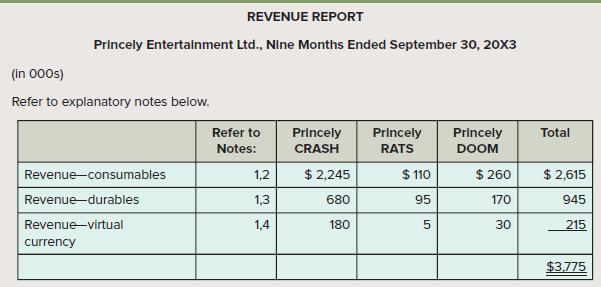

Frank has reviewed the cash based revenue figures for 20X3 to date, per Exhibit 1. He explains that his expectations from hiring a professional accountant include having someone put the accounting policies in order and get the financial statements verified by external accountants. Frank is attentive to general business news, is involved with local business groups, and has some general awareness of specific accounting concepts. Frank asks that within the specific context of PEL, you explain the similarities and differences between Canadian Accounting Standards for Private Enterprises (ASPE) and International Financial Reporting Standards (IFRS). Then, you are to identify the reporting issues facing PEL, and draft a report that sets out reporting policy alternatives and your recommendations. Based on your recommendations, you will have to recalculate revenue and any related balance sheet accounts.

Exhibit 1

Princely DOOM is a game that Frank purchased in 20X3 from its developer, in exchange for 250 common shares of PEL. The developer was working independently and had developed a highly viable game, but lacked the ability to scale it up. PEL has provided upgrades, added functionality, and integrated DOOM with the Princely playing platform. The game developer now works for PEL on salary, but is entitled to a royalty stream of 20% of revenue from this game for five years beginning in 20X3. The common shares (and DOOM) have been recorded at $1 in the accounts; Frank is not sure how to value this transaction or even whether it has to be recorded at all.

Required:

Prepare the report requested.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick