Refer to the information for Riley Inc. in E18.26. Instructions a. Assume that Riley Inc. uses a

Question:

Refer to the information for Riley Inc. in E18.26.

Instructions

a. Assume that Riley Inc. uses a valuation allowance to account for deferred tax assets, and also that it is more likely than not that 25% of the carryforward benefits will not be realized. Prepare the journal entries for 2020 and 2021.

b. Based on your entries in part (a), prepare the income tax section of the 2020 and 2021 income statements, beginning with the line “Income (loss) before income tax.”

c. Indicate how the deferred tax asset account will be reported on the December 31, 2020 and 2021 balance sheets. d. Assume that on June 30, 2021, the enacted tax rates changed for 2021. Should management record any adjustment to the accounts? If yes, which accounts will be involved and when should the adjustment be recorded?

e. Repeat part (c) assuming Riley Inc. follows IFRS.

Data From E18.26.

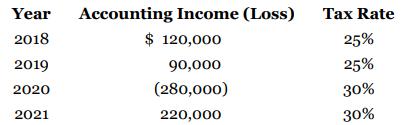

Riley Inc. reports the following pre-tax incomes (losses) for both financial reporting purposes and tax purposes:

The tax rates listed were all enacted by the beginning of 2018. Riley reports under the ASPE future/deferred income taxes method.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy