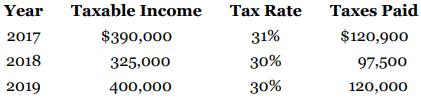

Roper Corporation had the following tax information: In 2020, Roper suffered a net operating loss of $550,000,

Question:

Roper Corporation had the following tax information:

In 2020, Roper suffered a net operating loss of $550,000, which it decided to carry back. The 2020 enacted tax rate is 25%. Prepare Roper's entry to record the effect of the loss carryback.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

Question Posted: