Royals Imports is a public company. It reported the following at the end of 20X5: The following

Question:

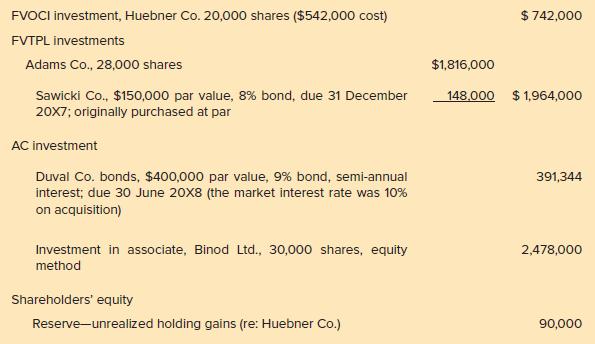

Royals Imports is a public company. It reported the following at the end of 20X5:

The following transactions and events took place in 20X6:

a. Dividends received, Huebner Co, $1.20 per share, Adams Co., $0.80 per share, Binod Ltd., $1.70 per share.

b. Semi annual interest was received on both bonds on 30 June.

c. Early in July, the Huebner Co. shares were sold for $807,000, and the Adams Co. shares were sold for $63.50 per share. Holding gains and losses in reserves are not reclassified on realization.

d. Three thousand Wong Ltd. shares were acquired for a total of $312,000. This is an FVTPL investment.

e. Royals owns 25% of the voting shares of Binod Ltd. Binod Ltd. reported earnings of $400,000 for 20X6. There was $216,000 of goodwill inherent in the original purchase price, and a fair value allocation on equipment, on which annual depreciation of $6,800 must be recorded.

f. The Sawicki Co. bond was sold for $142,800 plus accrued interest on 1 November 20X6.

g. Power Co. shares were acquired as a FVTPL investment, 600,000 shares for a total cost of $198,000.

h. Semi annual interest was received on the Duval Co bond at the end of December.

i. Wong Co. paid a dividend of $0.50 per share.

j. Fair values on 31 December 20X6: Wong Ltd., $99 per share; Power Co., $0.73 per share; Huebner Ltd., $60 per share; Adams Co., $97.

Required:

1. List the accounts and amounts that would appear in earnings. Also calculate the change in accumulated other comprehensive income for the year ended 31 December 20X6.

2. List the accounts and amounts that would appear on the statement of financial position for the year ended 31 December 20X6.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick