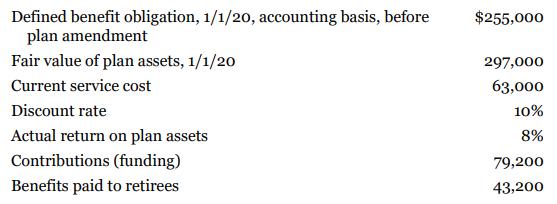

The following information is available for Antoine Corporation's pension plan for the 2020 fiscal year: On January

Question:

The following information is available for Antoine Corporation's pension plan for the 2020 fiscal year:

On January 1, 2020, Antoine Corp. amended its pension plan, resulting in past service costs with a present value of $140,400. Antoine follows ASPE.

Instructions

a. Calculate pension expense for 2020 and prepare journal entries to record the expense and funding for the year.

b. Determine the balance of the net defined benefit liability/asset reported on the December 31, 2020 balance sheet.

c. Prepare a 2020 pension work sheet for Antoine Corporation.

d. Identify the December 31, 2020 plan surplus or deficit and compare it with the asset or liability reported on the December 31, 2020 balance sheet.

e. Explain the result of your comparison in part (d).

f. Identify what would change if Antoine Corp. applied IFRS instead of ASPE.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy