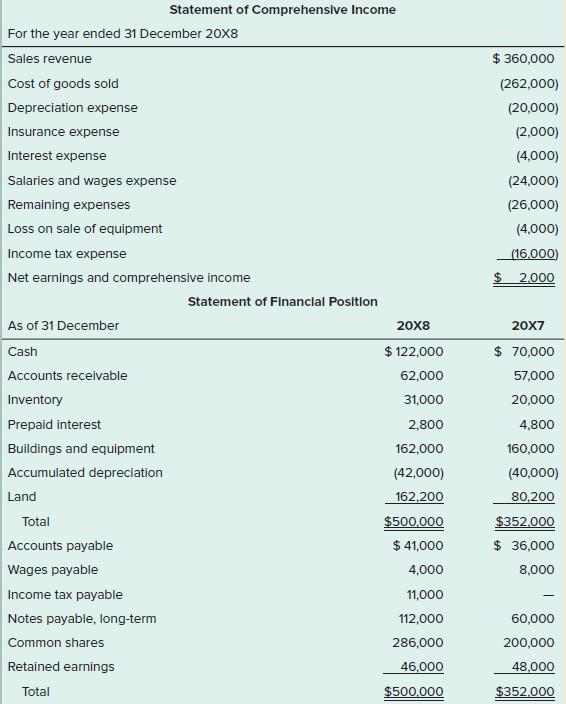

The records of Koop Co. provided the following information for the year ended 31 December 20X8: Additional

Question:

The records of Koop Co. provided the following information for the year ended 31 December 20X8:

Additional information:

a. Sold equipment for cash (cost, $30,000; accumulated depreciation, $18,000).

b. Purchased land, $40,000 cash.

c. Acquired land for $42,000 and issued common shares as payment in full.

d. Acquired equipment, cost $32,000; issued a $32,000, three-year, interest-bearing note payable.

Required:

Prepare the SCF, using the two-step indirect method. Analyze every account to ensure all changes are included. Assume unexplained changes are from logical sources. Include required note disclosure of non-cash transactions. Prepare separate disclosure of cash paid for interest and income tax, as is required by ASPE.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick