Tobita Limited, which follows IFRS, has adopted the policy of classifying interest paid as operating activities and

Question:

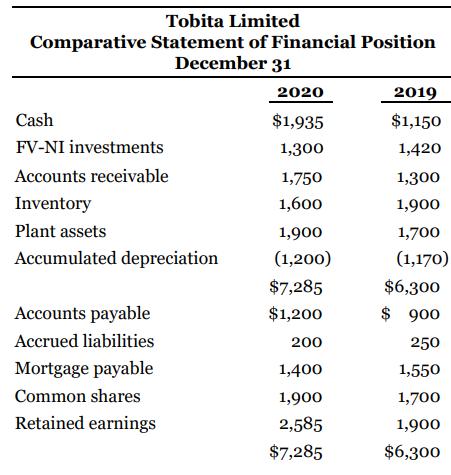

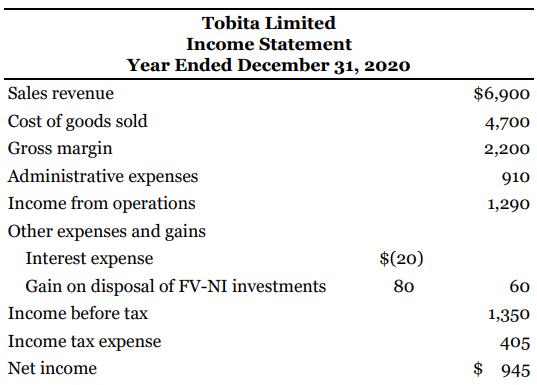

Tobita Limited, which follows IFRS, has adopted the policy of classifying interest paid as operating activities and dividends paid as financing activities. Condensed financial data for 2020 and 2019 follow (in thousands):

Additional information: During the year, $70 of common shares were issued in exchange for plant assets. No plant assets were sold in 2020. The FV-NI investments' carrying amount and market value were the same at December 31, 2020.

Instructions

a. Prepare a statement of cash flows using the indirect method.

b. Prepare a statement of cash flows using the direct method.

c. Does Tobita Limited have any options on how to classify interest and dividends paid on the statement of cash flows?

d. What would you consider to be an alarming trend that is revealed by the statements that you have prepared? Is it as easy to notice this trend using the direct method, as in part (b)?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy