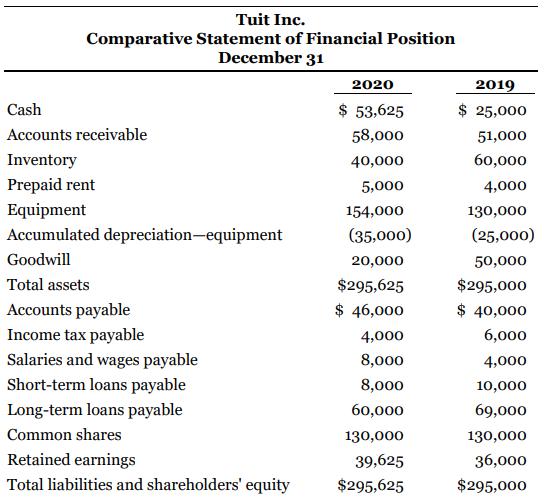

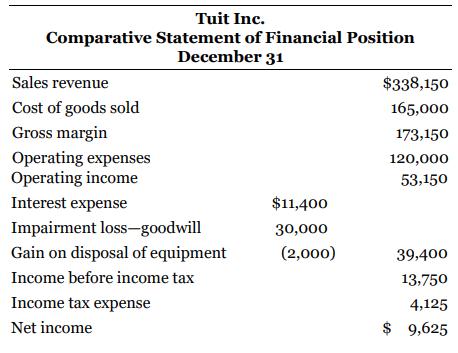

Tuit Inc., a greeting card company that follows ASPE, had the following statements prepared as at December

Question:

Tuit Inc., a greeting card company that follows ASPE, had the following statements prepared as at December 31, 2020:

Additional information:

1. Dividends on common shares in the amount of $6,000 were declared and paid during 2020.

2. Depreciation expense is included in operating expenses, as is salaries and wages expense of $69,000.

3. Equipment with a cost of $20,000 that was 70% depreciated was sold during 2020.

Instructions

a. Prepare a statement of cash flows using the direct method.

b. Prepare a statement of cash flows using the indirect method.

c. Does Tuit Inc. have any options on how to classify interest and dividends paid on the statement of cash flows?

d. From the perspective of an investor who is interested in investing in mature, successful companies, comment on Tuit Inc.'s sources and uses of cash by analyzing the company's statement of cash flows.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy