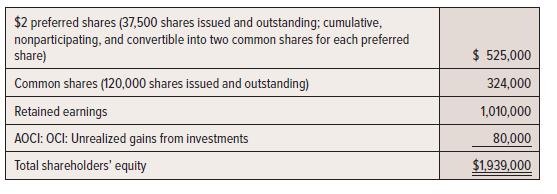

Altitude Ltd. had the following shareholders equity on 31 December 20X8: Earnings for 20X8 had been $216,000,

Question:

Altitude Ltd. had the following shareholders’ equity on 31 December 20X8:

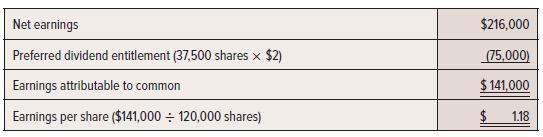

Earnings for 20X8 had been $216,000, and comprehensive income, which also included a $13,500 unrealized gain on an investment, was $229,500. Basic earnings per share was calculated as $1.18:

During 20X8, the company paid the $2 per share preferred dividends and also paid $90,000, or $0.75 per share, in dividends to common shareholders. Dividends are reported in total and per share in the financial statements. On 1 April 20X9, Altitude executed a 3-for-1 split of its common shares. All share contracts were revised to reflect this split. On 15 July 20X9, the company repurchased and retired 9,000 common shares at $11 per share.

Required:

1. Prepare the journal entry to record the 20X9 share repurchase.

2. Post-split, how many common shares would the holder of 4,000 preferred shares receive on conversion?

3. When the company prepares its comparative financial statements for 20X9, what amount will be reported for 20X8 earnings per share? What amount would be reported for 20X8 cash dividends per common share?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel