AGF Foods Company is a large, primarily domestic, consumer foods company involved in the manufacture, distribution, and

Question:

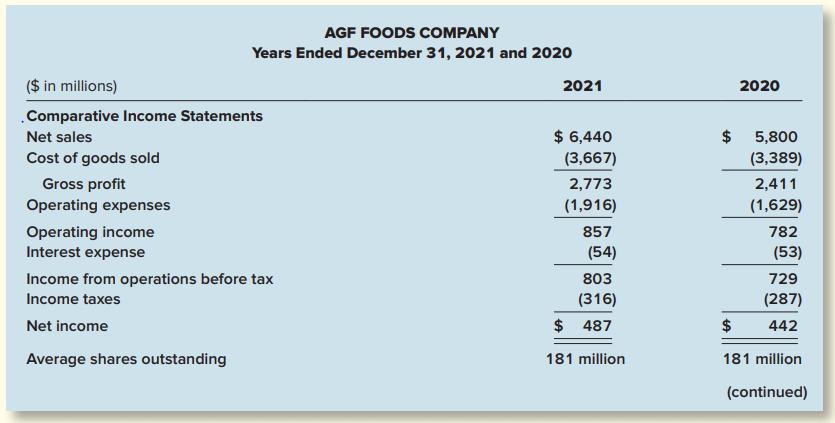

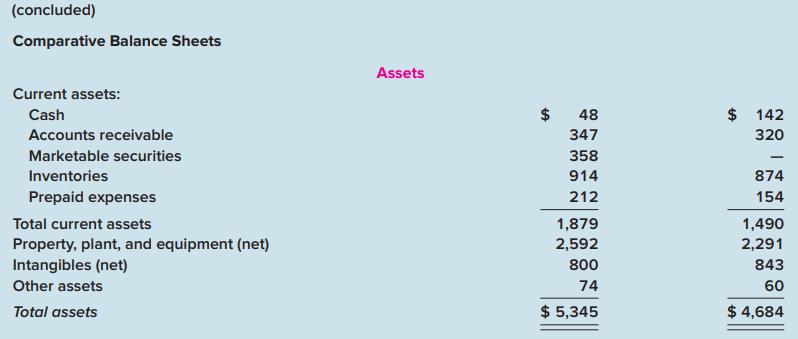

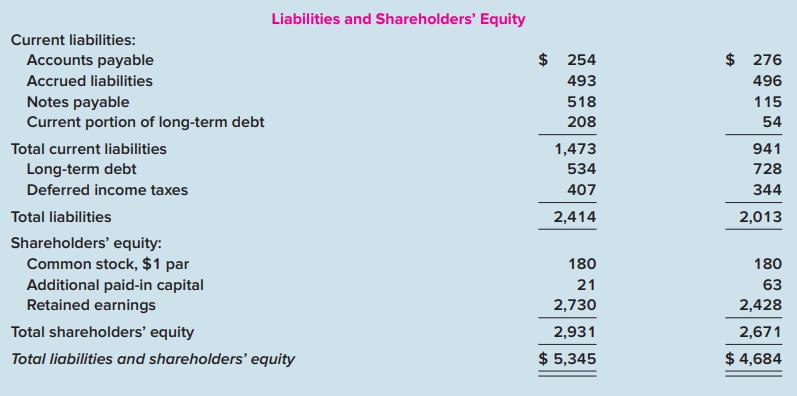

AGF Foods Company is a large, primarily domestic, consumer foods company involved in the manufacture, distribution, and sale of a variety of food products. Industry averages are derived from Troy’s The Almanac of Business and Industrial Financial Ratios and Dun and Bradstreet’s Industry Norms and Key Business Ratios. Following are the 2021 and 2020 comparative income statements and balance sheets for AGF. The market price of AGF’s common stock is $47 at the end of 2021. (The financial data we use are from actual financial statements of a well-known corporation, but the company name used in our illustration is fictitious and the numbers and dates have been modified slightly to disguise the company’s identity.) Profitability is the key to a company’s long-run survival.

Profitability measures focus on a company’s ability to provide an adequate return relative to resources devoted to company operations.

Required:

1. Calculate the return on shareholders’ equity for AGF. The average return for the stocks listed on the New York Stock Exchange in a comparable period was 18.8%. What information does your calculation provide an investor?

2. Calculate AGF’s earnings per share and earnings-price ratio. The average return for the stocks listed on the New York Stock Exchange in a comparable time period was 5.4%. What does your calculation indicate about AGF’s earnings?

Financial RatiosThe term is enough to curl one's hair, conjuring up those complex problems we encountered in high school math that left many of us babbling and frustrated. But when it comes to investing, that need not be the case. In fact, there are ratios that,...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas