Andrew, Inc. provides DJ services for corporate parties. Andrew reported a net operating loss of $750,000 on

Question:

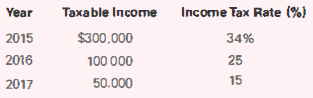

Andrew, Inc. provides DJ services for corporate parties. Andrew reported a net operating loss of $750,000 on its 2018 tax return. During the 3 preceding years, Andrew had taxable income and paid taxes at various tax rates as follows:

Although Andrew had a net operating loss in 2018, it was because of an unusual event. Andrew's management has substantial evidence to indicate that the company will be profitable over the foreseeable future and will incur a 34% tax rate for each of those year's. In fact, during 2019, Andrew reported a profit before tax of $800,000. Andrew does not report any book-tax differences.

Required

a. Prepare the journal entries to account for the NOL carry back and NOL carryforward in 2018.

b. Compute reported net income (loss) after tax for 2018.

c. Prepare the journal entries to account for income taxes in 2019.

d. Compute reported net income after tax for 2019.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella