Big City Gymnastics (BCG or the Club) is a not-for-profit organization that operates a gymnastics club. BCG

Question:

BCG is governed by an elected board of directors of 10 members, all of whom are parents of athletes who train at the Club.

BCG trains both male and female athletes, from preschool to young adult. Its programs are preschool gymnastics, recreational gymnastics, and competitive gymnastics. BCG€™s athletes have qualified for national and international gymnastics meets, with some even going on to full scholarships at Canadian and American universities. BCG€™s coaches and programs are recognized by the Canadian gymnastics community as being of high quality.

Like most gymnastics clubs, BCG has paid coaching staff. Salaried staff, paid in total $20,000 a month including all required government remittances, include an office manager, a program director who coaches and also oversees the program and staffing, and three head coaches who oversee, respectively, the women€™s competitive, men€™s competitive, and recreational/preschool programs.

You are the parent of a gymnast. You were appointed to the board of BCG as treasurer three-and-a-half weeks ago. During your short time as treasurer, you have interviewed the office manager ( Exhibit I ) to become familiar with the workings of BCG, and gathered some historical financial information ( Exhibit II ).

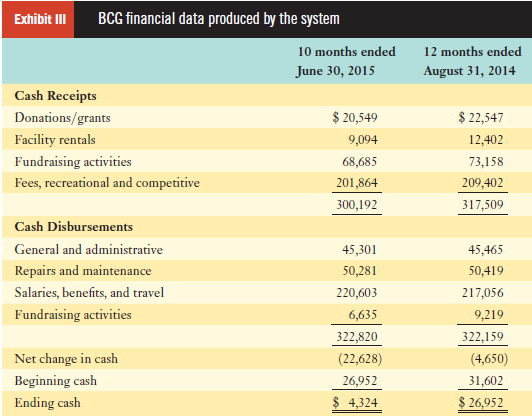

Today, July 23, 2015, the president of BCG, Jim Taylor, approached you while you were watching your daughter train at BCG€™s facility. He informed you that the treasurer is responsible for preparing and presenting a financial report to the BCG board of directors at each monthly board meeting. Jim mentioned that, in the past, the report usually consisted of a quick update on the cash balance in the Club€™s bank account. At the May 2015 board meeting, the report stated a cash balance of $19,823. At the board meeting on June 30, 2015, the cash balance was $4,324. The board was concerned about the deteriorating cash situation and wondered how it would look at the end of the fiscal year.

At previous board meetings, members often asked for more financial information but the previous treasurer was unable to provide it. Jim let you know that the lack of information caused some frustration among the board members and asks you to recommend reporting improvements to the board.

As you think about Jim€™s comments, you remember that, as a parent of a BCG athlete, you had your own questions about the financial situation of BCG, the success of the various programs and of the fundraisers, and so on. You tell Jim that your report will be different. You will report to the board the findings from your recent discussions and recommendations for improvement, and you will provide some insights into BCG€™s current financial situation.

Required:

Prepare the report, paying specific attention to (i) BCG€™s cash flow and (ii) the sufficiency of the financial reports currently being produced.

Exhibit I

The office manager is Joan Epp. She was hired three weeks ago to replace the outgoing office manager, Tom Dickens, who quit after only 11 months on the job. Joan€™s role as office manager:

- Receive payments from athletes€™ families for their gymnastics fees. These fees are paid monthly in advance. BCG accepts cash, cheques, and credit card payments. Receipts are issued upon request.

- Tally the cash received and credit card slips on a deposit sheet and enter the amounts monthly into the accounting records. Deposits are made on an occasional basis at the nearby bank branch, once sufficient cash has been accumulated to warrant making a deposit.

- Receive and pay suppliers€™ invoices. One signature is required for all cheques. Signing

officers are the office manager, the treasurer, and the president.

Joan reviewed the records on her first day. She had examined the paid invoices, stored in a filing cabinet, to become familiar with BCG€™s operations. Joan mentioned that there were several small cheques, most of which were posted as debits to the revenue accounts, that did not have corresponding invoices. Most of those cheques were made out to Tom Dickens. Also, one large cheque for $5,617 had a note that it was to reimburse Tom for the purchase of a trampoline, but no supporting invoice was attached. Joan also noted there were several cheques to suppliers, totalling $820, that are still outstanding.

As far as Joan is aware, there is no formal policy established for approval of spending. Joan can order what she needs for her job. Coaches can order the equipment or other gymnastics materials that they believe are needed for BCG€™s various programs.

Exhibit I

BCG has a chocolate fundraiser where athletes sell chocolate bars for $3 apiece. An envelope marked Chocolate Fundraiser was in Joan€™s desk. It had $3,750 cash in it, with various notes on who had paid for chocolate bars. The drawer is locked when Joan is out of the office. Joan will deposit the money as soon as all the chocolate bars are sold, so that she will know the exact amount raised. The chocolate supplier shipped 1,500 chocolate bars. Joan received an invoice for $3,300, dated July 20, from the chocolate supplier. The terms on the invoice are that any unsold chocolate bars cannot be returned and, if payment is made within 30 days, the supplier€™s discount is 20%.

Exhibit II

The fiscal year-end of the Club is August 31.

Revenues are seasonal. The fall and winter recreational sessions are busy. The competitive season starts in September and runs through June. The spring recreational session appears to have one-third less revenue than the other two sessions due to the start of competing outdoor sports in the spring (baseball, football, soccer, etc.). The two summer months provide approximately 10% of BCG€™s annual revenue because of school summer holidays. Some weekly gymnastics camps are run, but attendance is muted due to athletes being away or taking time off . In addition to the chocolate fundraiser, BCG holds two other fundraisers during the year.

BCG receives a grant of $1,200 per month from the citywide gymnastics organization. General and administrative costs include building rent and utilities, which combined are approximately $2,000 per month.

The net book value of BCG€™s equipment was $54,563 as of August 31, 2014. BCG does not have any bank loans or lines of credit because it has never needed credit.

Step by Step Answer: