Companies following international accounting standards are permitted to revalue fixed assets above the assets? historical costs. Such

Question:

Companies following international accounting standards are permitted to revalue fixed assets above the assets? historical costs. Such revaluations are allowed under various countries? standards and the standards issued by the IASB. Liberty International, a real estate company headquartered in the United Kingdom (U.K.), follows U.K. standards. In a recent year, Liberty disclosed the following information on revaluations of its tangible fi xed assets. The revaluation reserve measures the amount by which tangible fi xed assets are recorded above historical cost and is reported in Liberty?s stockholders? equity.

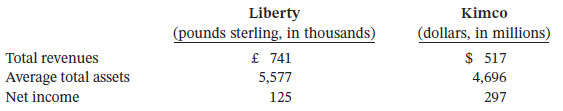

Liberty reported the following additional data. Amounts for Kimco Realty (which follows GAAP) in the same year are provided for comparison.

Instructions

a. Compute the following ratios for Liberty and Kimco.

1. Return on assets.

2. Profit margin on sales.

3. Asset turnover.

How do these companies compare on these performance measures?

b. Liberty reports a revaluation surplus of ?1,952. Assume that ?1,550 of this amount arose from an increase in the net replacement value of investment properties during the year. Prepare the journal entry to record this increase.

c. Under U.K. (and IASB) standards, are Liberty?s assets and equity overstated? If so, why? When comparing Liberty to U.S. companies, like Kimco, what adjustments would you need to make in order to have valid comparisons of ratios such as those computed in (a) above?

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel