Del Conte Construction Company has experienced generally steady growth since its inception in 1973. Management is proud

Question:

Del Conte Construction Company has experienced generally steady growth since its inception in 1973. Management is proud of its record of having maintained or increased its earnings per share in each year of its existence. The economic downturn has led to disturbing dips in revenues the past two years. Despite concerted cost-cutting efforts, profits have declined in each of the two previous years. Net income in 2019, 2020, and 2021 was as follows:

2019...............145 million

2020...............$134 million

2021................$ 95 million

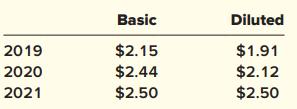

A major shareholder has hired you to provide advice on whether to continue her present investment position or to curtail that position. Of particular concern is the declining profitability, despite the fact that earnings per share has continued a pattern of growth:

She specifically asks you to explain this apparent paradox. During the course of your investigation you discover the following events:

• For the decade ending December 31, 2018, Del Conte had 60 million common shares and 20 million shares of 8%, $10 par nonconvertible preferred stock outstanding. Cash dividends have been paid quarterly on both.

• On July 1, 2020, half the preferred shares were retired in the open market. The remaining shares were retired on December 30, 2020.

• $55 million of 8% nonconvertible bonds were issued at the beginning of 2021, and a portion of the proceeds were used to call and retire $50 million of 8% debentures (outstanding since 2016) that were convertible into 9 million common shares.

• In 2019, management announced a share repurchase plan by which up to 24 million common shares would be retired. 12 million shares were retired on March 1 of both 2019 and 2020. • Del Conte’s income tax rate is 25% and has been for the last several years.

Required:

In preparation for your explanation of the apparent paradox to which your client refers, calculate both basic and diluted earnings per share for each of the three years.

DebenturesDebenture DefinitionDebentures are corporate loan instruments secured against the promise by the issuer to pay interest and principal. The holder of the debenture is promised to be paid a periodic interest and principal at the term. Companies who...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas