During 2014, you were hired as the chief financial officer for MC Travel Inc., a fairly young

Question:

During 2014, you were hired as the chief financial officer for MC Travel Inc., a fairly young travel company that is growing quickly. A key accounting staff member has prepared the financial statements, but there are a couple of transactions that have not been recorded yet because she is waiting for your guidance regarding how these transactions should be recorded. In addition, the staff member is not confident in preparing cash flow statements, so you have been asked to prepare this statement for the 2014 year. MC Travel Inc. reports under ASPE.The transactions that have not been recorded yet are as follows.

1. On January 1, 2012, the company purchased a small hotel property in Miami for $50 million, paying $10 million in cash and issuing a 5%, $40-million bond at par to cover the balance. The bond principal is payable on January 1, 2022. When you were hired and began to review the financial information from previous years, you quickly realized that the land portion of the total purchase price had been capitalized with the building, and depreciated. Depreciation has been incorrectly recorded on the building for 2012, 2013, and 2014, and the land is still included i the building account. The land portion of the purchase was appraised at $15 million in 2012, and the land is currently worth $17 million. The cost of the property is to be amortized over a 20-year period using the straight-line basis, and a residual value of $5 million. The company’s tax rate is 30%.

2. During 2014, the president, who is also the principal shareholder in the business, transferred ownership of a vacant piece of land in the Caribbean to the company. A hotel will be constructed on this property beginning in 2015. The cost when the president purchased this property was $10 million, and the fair market value, based on a professional appraisal, at the time it was transferred to the company was $25 million. The president was issued 50,000 common shares in exchange for this land. This transaction has not yet been booked.

Additional information that you have gathered to assist in preparing the cash flow statement is as follows.

1. In 2014, equipment was purchased for $250,000. In addition, some equipment was disposed of during the year.

2. Investment income includes a dividend of $150,000 received on the temporary investment. Interest income of $106,000 was reinvested in fair value-net income investments.

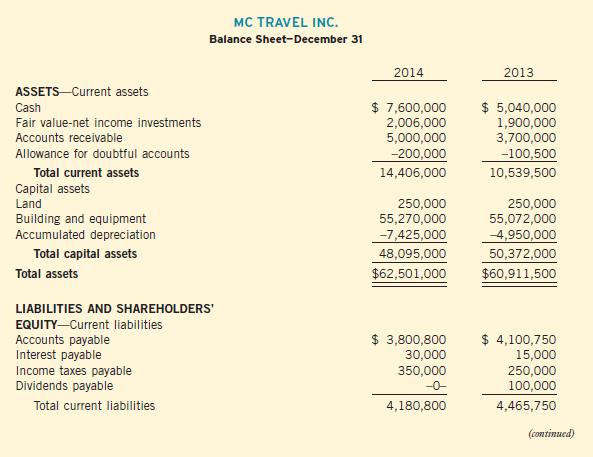

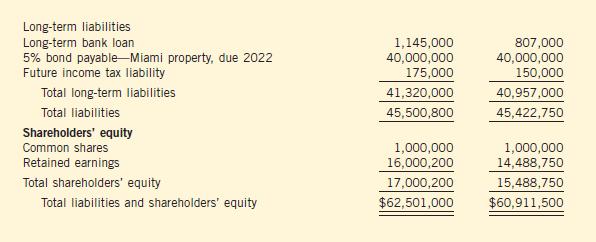

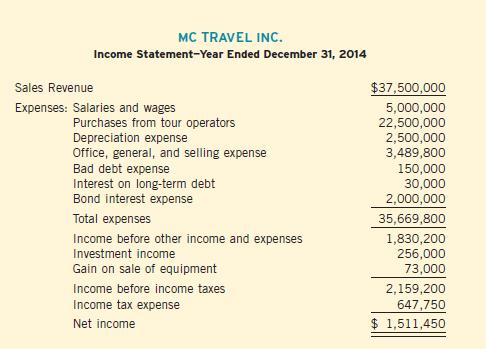

Following are the financial statements for MC Travel Inc. for the 2014 and 2013 fiscal years.

Instructions

From the information supplied, complete the necessary entries to record the two transactions that have not been recorded, and prepare a revised balance sheet and income statement for the year, keeping in mind that comparative figures will need to be restated. Once this is complete, prepare a statement of cash flows in good form using the direct method for the year ended December 31, 2014. Assume all transaction amounts have been reported in Canadian dollars.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1118300855

10th Canadian Edition Volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Nicola M. Young, Irene M. Wiecek, Bruce J. McConomy