During 2019 (its first year of operations) and 2020, Fieri Foods used the FIFO inventory costing method

Question:

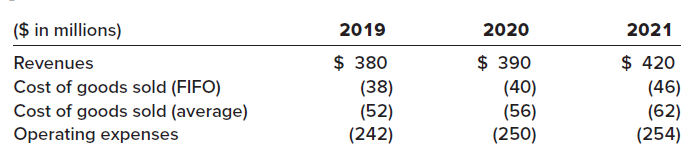

During 2019 (its first year of operations) and 2020, Fieri Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2021, Fieri decided to change to the average method for both financial reporting and tax purposes. Income components before income tax for 2019, 2020, and 2021 were as follows:

Dividends of $20 million were paid each year. Fieri ?s fiscal year ends December 31.

Required:1. Prepare the journal entry at the beginning of 2021 to record the change in accounting principle. (Ignore income taxes.)2. Prepare the 2021?2020 comparative income statements.3. Determine the balance in retained earnings at January 1, 2020, as Fieri reported previously using the FIFO method.4. Determine the adjustment to the January 1, 2020, balance in retained earnings that Fieri would include in the 2021?2020 comparative statements of retained earnings or retained earnings column of the statements of shareholders? equity to revise it to the amount it would have been if Fieri had used the average method.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas