Each of the four independent situations below describes a sales-type lease in which annual lease payments of

Question:

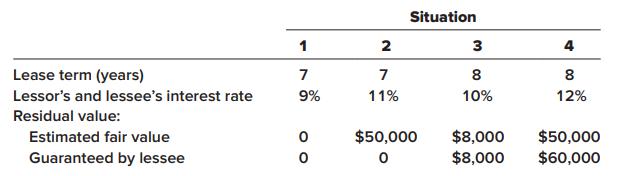

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $100,000 are payable at the beginning of each year. Each is a finance lease for the lessee. Determine the following amounts at the beginning of the lease:

A. The lessor’s

1. Lease payments

2. Gross investment in the lease

3. Net investment in the lease

B. The lessee’s

4. Lease payments

5. Right-of-use asset

6. Lease liability

Transcribed Image Text:

Situation 1 2 3 4 Lease term (years) 7 7 8 8 Lessor's and lessee's interest rate 9% 11% 10% 12% Residual value: $50,000 $8,000 $8,000 $50,000 $60,000 Estimated fair value Guaranteed by lessee

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

answer A The lessors 1 Lease payments 100000 2 Gross investment in the lease Lease ...View the full answer

Answered By

Maurat Ivan

I have been working in the education and tutoring field for the past five years, and have gained a wealth of experience and knowledge in this area. I have a bachelor's degree in education, and have completed additional coursework in teaching and tutoring.

In my previous roles, I have worked as a teacher in both private and public schools, teaching a variety of subjects including math, science, and English. I have also worked as a private tutor, providing one-on-one tutoring to students in need of additional support and guidance.

In my current role, I work as an online tutor, providing virtual tutoring services to students around the world. I have experience using a variety of online tutoring platforms and technologies, and am comfortable working with students of all ages and skill levels.

I am passionate about helping students succeed and reach their full potential, and I believe that my education and tutoring experience make me an excellent candidate for a tutoring job at SolutionInn. I am confident that my knowledge, skills, and experience will enable me to provide top-quality tutoring services to students on the SolutionInn platform.

0.00

0 Reviews

10+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 9781259722660

9th Edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Question Posted:

Students also viewed these Business questions

-

Each of the four independent situations below describes a capital lease in which annual lease payments are payable at the beginning of each year. Determine the annual lease payments foreach:...

-

Each of the four independent situations below describes a lease requiring annual lease payments of $10,000. For each situation, determine the appropriate lease classification by the lessee and...

-

Each of the four independent situations below describes a lease requiring annual lease payments of $10,000. For each situation, determine the appropriate lease classification by the lessee and...

-

Consider the following NLP problem: Maximize 2Xi + X2 - 2X3 + 3XiX2 + 1X subject to the constraints (a) Set up and solve the model by using Solver. Use a starting value of zero for each decision...

-

You have recently been hired to work in the accounts receivable department of Canadian Moonlighting Film Inc. (CMF). As part of your introduction and familiarization with the company, you are...

-

A country enacts a law that denies import privileges for five years to any firm that dumps products for sale in its markets at less than normal value. Do the WTO antidumping agreements permit such a...

-

Image intensifiers used in nightvision devices create a bright image from dim light by letting the light first fall on a photocathode. Electrons emitted by the photoelectric effect are accelerated...

-

Crimson Tide Music Academy offers lessons in playing a wide range of musical instruments. The unadjusted trial balance as of December 31, 2021, appears below. December 31 is the company?s fiscal...

-

a) Draw the Control Flow Automaton (CFA) model of the program sample. Use the numbers specified next to the statements (0, 1, 2) to label the CFA locations. Use a specific location err for the case...

-

Roberto Martinez was the sole force behind In Over Our Heads, Inc., a corporation designed to run a year-round community swimming pool. The enterprise was incorporated in the correct manner in...

-

Each of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessors implicit rate of...

-

For each of the three independent situations below determine the amount of the annual lease payments. Each describes a finance lease in which annual lease payments are payable at the beginning of...

-

Discuss the nature of the major federal labor relations laws.

-

Recently, the Millennial generation outnumbered the Baby Boomers, becoming the most populous generation today. One of the strong values of the Millennials is work / life balance. As Millennials move...

-

You are considering an investment in Longfellow stock, which is expected to pay a dividend of $2.50 a share one year from now. Assume you require a return of 15.5% on this investment and the stock...

-

From contracts to torts, common law is a cornerstone of hospitality law. For this discussion, provide your perspective of common law and the development of rules regarding the rights and liabilities...

-

What are the differences between a preparation outline and a speaking outline? Why are these two different types of outlines important in the speech making process?

-

The goal of the capital budgeting process is to try to ensure that the firm's major investments are worth more than they cost. Question 18 options: True False

-

Peleh writes a put option on Japanese yen with a strike price of $0.008000/ (125.00/$) at a premium of 0.0080 per yen and with an expiration date six month from now. The option is for 12,500,000....

-

The manager for retail customers, Katie White, wants to hear your opinion regarding one business offer she has received from an entrepreneur who is starting a mobile phone app called Easy Money. The...

-

Use the information for Lockard Company given in BE11-2. (a) Compute 2010 depreciation expense using the double-declining-balance method. (b) Compute 2010 depreciation expense using the...

-

Cominsky Company purchased a machine on July 1, 2011, for $28,000. Cominsky paid $200 in title fees and county property tax of $125 on the machine. In addition, Cominsky paid $500 shipping charges...

-

Dickinson Inc. owns the following assets. Compute the composite depreciation rate and the composite life of Dickinson's assets. Estimated Useful Life 10 years Cost Asset Salvage A $70,000 $ 7,000...

-

QUESTION to answer for the Company Nuvalent, INC: VI. Implementation, Evaluation and Control of Strategies (This is all estimations) a. Explain in more detail how each recommended strategy within the...

-

a. Explain the results of ANOVA analysis using hypothesis testing procedure (5 marks). Descriptives ***My favourite sports person acts as a role model for me 95% Confidence Interval for Mean N Mean...

-

Galt Motors currently produces 50,000 electric motors a year and expects output levels to remain steady in the future. It buys armatures from an outside supplier at a price of $2.00 each. The plant...

Study smarter with the SolutionInn App