Early one Wednesday afternoon, Ken and Larry studied in the dormitory room they shared at Fogelman College.

Question:

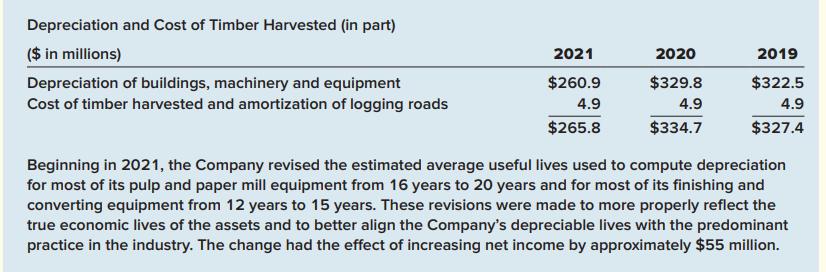

Early one Wednesday afternoon, Ken and Larry studied in the dormitory room they shared at Fogelman College. Ken, an accounting major, was advising Larry, a management major, regarding a project for Larry’s Business Policy class. One aspect of the project involved analyzing the 2021 annual report of Craft Paper Company. Though not central to his business policy case, a footnote had caught Larry’s attention.

“If I understand this right, Ken, the company is not going back and recalculating a lower depreciation for earlier years. Instead they seem to be leaving depreciation overstated in earlier years and making up for that by understating it in current and future years,” Larry mused. “Is that the way it is in accounting? Two wrongs make a right?”

Required:

What are the two wrongs to which Larry refers? Is he right?

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas