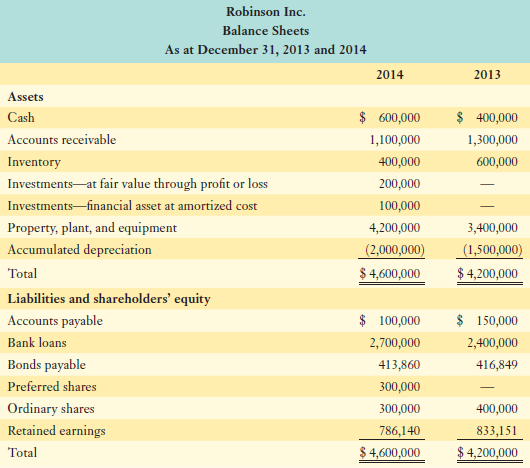

Financial information for Robinson Inc. follows: Additional information: Ordinary shares were redeemed during the year at their

Question:

Additional information:

- Ordinary shares were redeemed during the year at their book value.

- The face value of the bonds is $400,000; they pay a coupon rate of 7% per annum. The effective interest rate of interest is 6% per annum.

- Net income was $100,000.

- There was an ordinary stock dividend valued at $20,000 and cash dividends were also paid.

- Interest expense for the year was $100,000. Income tax expense was $50,000.

- Robinson arranged for a $500,000 bank loan to finance the purchase of equipment.

- Robinson sold equipment with a net book value of $150,000 (original cost $200,000) for $180,000 cash.

- Robinson acquired equipment costing $250,000 under a finance lease.

- Robinson has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating activities.

- The at fair value through profit or loss investments are cash equivalents.

Required:

a. Prepare a statement of cash flows for the year ended December 31, 2014, using the indirect method.

b. Discuss how the transaction(s) above that are not reported on the statement of cash flows are reported in the financial statements.

A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: