In 2018, Sawyer Company experienced a major casually loss. The roof of its ware house collapsed finance

Question:

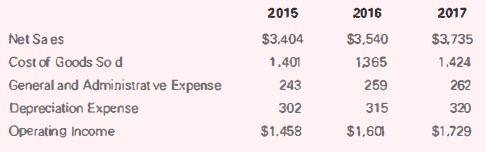

In 2018, Sawyer Company experienced a major casually loss. The roof of its ware house collapsed finance storm and destroyed its entire inventory. The company began the year with inventory of $598. It made purchases of $2,400 but returned $24 worth of merchandise. Sales prior to the ice storm were $3.945. Sawyer must use the gross profit method to determine inventory on hand on the date of the casualty. Round percentages to one decimal place. The following is an excerpt of its income statement for the last three years.

Required

a. Assume that Sawyer uses the most recent three years of net sales and cost of goods sold to determine its historical gross profit. What are estimated cost of goods sold. estimated gross profit. and estimated ending inventory?

b. Assume that Sawyer uses the most recent two years of net sales and cost of goods sold to determine its historical gross profit. What are estimated cost of goods sold, estimated gross profit, and estimated ending inventory?

c. Comment on the differences in estimated cost of goods sold, estimated gross profit, and estimated ending inventory from pans (a) and (b).

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella