In preparation for significant expansion of its international operations, ABC Co. has adopted a plan to gradually

Question:

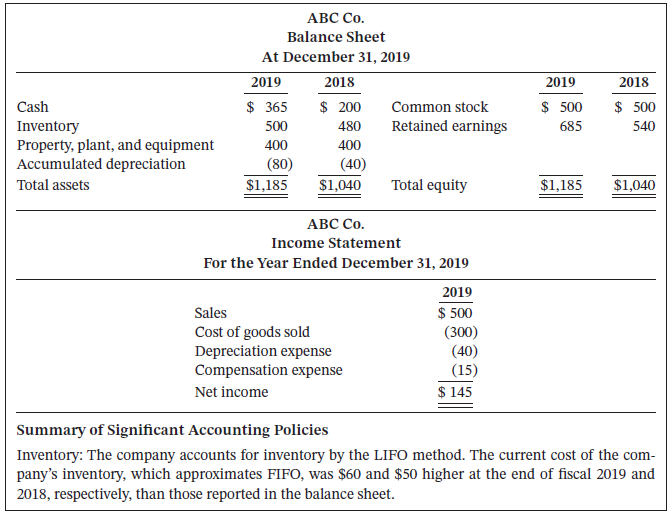

In preparation for significant expansion of its international operations, ABC Co. has adopted a plan to gradually shift to the same accounting methods as used by its international competitors. Part of this plan includes a switch from LIFO inventory accounting to FIFO (recall that IFRS does not allow LIFO). ABC decides to make the switch to FIFO at January 1, 2020. The following data pertains to ABC?s 2020 financial statements (in millions of dollars).

Sales....................................................................$550Inventory purchases...........................................35012/31/20 inventory (using FIFO)........................580Compensation expense.......................................17

All sales and purchases were with cash. All of 2020?s compensation expense was paid with cash. (Ignore taxes.) ABC?s property, plant, and equipment cost $400 million and has an estimated useful life of 10 years with no salvage value.

ABC Co. reported the following for fiscal 2019 (in millions of dollars):

Accounting

Prepare ABC?s December 31, 2020, balance sheet and an income statement for the year ended December 31, 2020. In columns beside 2020?s numbers, include 2019?s numbers as they would appear in the 2020 financial statements for comparative purposes.

Analysis

Compute ABC?s inventory turnover for 2019 and 2020 under both LIFO and FIFO. Assume averages are equal to year-end balances where necessary. What causes the differences in this ratio between LIFO and FIFO?

Principles

Briefly explain, in terms of the principles discussed in Chapter 2, why GAAP requires that companies that change accounting methods recast prior year?s financial statement data.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... GAAP

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel