Mountain Mines Lubrication Ltd. (MML) supplies lubricant to mining operations in northern British Columbia and the Northwest

Question:

The mining industry has not performed well in recent years, but over the last summer the economy has picked up and, according to MML€™s owner, Max Mulholland, the BC mines are running at peak capacity. Customer service is key to the business. Max says that MML has been able to survive the hard times because it is more flexible and its products cost less than those of its competitors.

MML is a new client of your firm. You, a CA, have been assigned to conduct the review engagement. You have met with Max and with Nina Verhan, the bookkeeper. Your notes are in Exhibits I and II. You have been working at the client€™s office for two days. The partner would like a memo analyzing the issues you have identified in the review.

Required:

Prepare the memo to the partner.

Exhibit I

€œI do everything I can to keep costs down. Minimizing costs is vital in our business. Take shipping costs. Some of my clients are in pretty remote areas, and it costs a lot to ship lubricant up there. So I send enough lubricant up there in one shipment to last them for a year. They put the stuff in their machines as they need it, and report to me how much they€™ve used. When my sales rep makes the annual delivery, he confirms the information they have provided. That way they are happy because they don€™t have to wait for lubricant to be delivered, and I keep my costs and my prices low.

€œOf course, there are always problems. On August 30, the supervisor at Scorched Earth called to warn me they were really low on lubricant. That was a bit of a surprise to me, because we shipped a lot up there in the spring, but I know they€™ve been working hard in August and those older machines really go through the stuff.

€œFlexibility is another strong point. You know things have been bad in the mining industry, but they have picked up this year, which means that our business has picked up as well. Some mines were experiencing cash flow problems and, even though lubricant is not their biggest expense, every little bit helps. So instead of charging them for product as they put it into their machines, I€™ve arranged to have meters installed to read the number of hours a machine is in use and they are charged based on hours of usage. It takes about four weeks before a machine needs to have its lubricant tanks refilled, if it is running at peak capacity.€

Exhibit II

€œMax is excited about this year. A lot of orders have come in since the mines started picking up. We were concerned about cash flows, but Max thinks they are going to be okay. Big Scar Mine, a new diamond mine in the Northwest Territories, has started operations, and we are its supplier.

€œMax told you about our new charging plan, based on hourly usage. When the mine workers pour lubricant into the tank on one of their machines, they let me know by fax. I send them a €œno charge€ invoice, and at the same time I charge the cost of lubricant to cost of sales. Max thinks that it is a good reminder of the special deal we are giving them. Then, each week, they fax in their meter readings, and I charge them based on the hours of operation of the machine and I record the revenue at that time. We just started doing it this way this year, for three of our four customers. Here is our inventory list for all our mines (see Exhibit III).

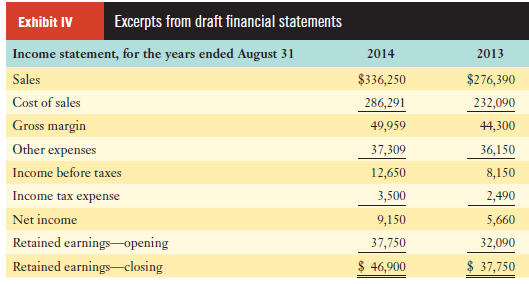

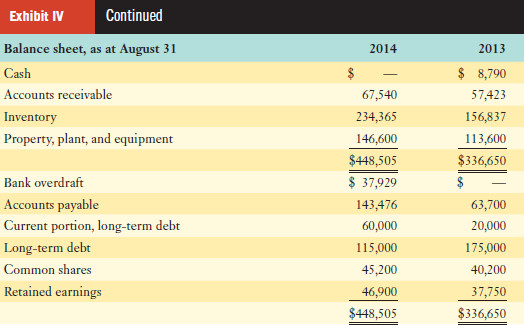

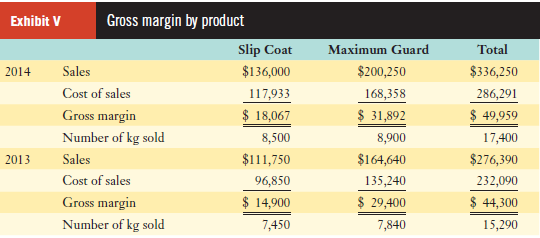

€œI€™ve also prepared draft financial statements for you. Here are some excerpts (see Exhibit IV), and the gross margins by product (Exhibit V).

€œOur three BC mine customers have really picked up over the summer. For July, August, and September they have been running at full capacity. The Scorched Earth Mine is the only one in BC not owned by Broken Wing Properties, and it has really been financially squeezed lately. Scorched Earth was pretty eager to switch to our new hourly usage billing, because its cash flow was tight.

€œBased on our average selling prices and costs, you will see that our percentage gross margins have increased over last year, and our volume of sales has also increased nicely. I would say we have had a pretty good year.

€œThe Big Scar Mine has a large amount of our inventory onsite. That mine is owned and operated by North Canadian Developments Ltd., a subsidiary of Broken Wing Properties.

€œWe have received all the meter readings from our hourly usage customers up to August 31. I noticed that the Scorched Earth Mine meter reading is low, so I will ask our sales rep to recheck the meter when he makes another delivery this week. I have billed Scorched Earth for August on the hours that the mine has provided.€

Notes:

Notes:

1. Scorched Earth Mine, Moon Crater Mine, and Big Scar Mine are billed by hourly machine usage. Dead Fish Mine is billed for product when it is poured into the tanks.

2. Onsite does not include lubricant contained in the machines.

Step by Step Answer: