On August 31, 2019, Angela Corp. (AC) classified a surplus machine as held for sale. The equipment

Question:

On August 31, 2019, Angela Corp. (AC) classified a surplus machine as held for sale. The equipment is available for immediate sale and is expected to sell within one year. Pertinent information follows:

- AC??s reports its financial results in accordance with IFRS. Its year-end is December 31.

- The surplus machine has historically been accounted for using the cost model.

- The net book value of the equipment at August 31, 2019, was $360,000 ($600,000 cost minus $240,000 accumulated depreciation). The equipment has been depreciated at $10,000 per month, which was last taken on August 31, 2019.

- The estimated costs of disposal are $15,000.

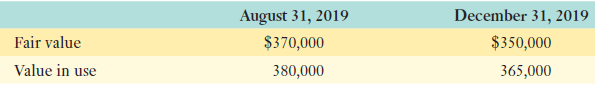

- Estimates of value follow:

- AC sold the equipment on January 15, 2020, for $368,000 cash less disposal costs of $19,000.

Required:Prepare the necessary journal entries to reflect the forgoing events.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: